Banks, oil companies face probe over $30bn revenue loss

As Nigeria faces serious cash crunch and economic downturn, major players in the oil and gas industry are facing probe over their role in an alleged annual loss of revenue, to the tune of $30billion.

- TAJBank launches Nigeria’s first ethical Online Mall

- CBN’s agric loan: Stakeholders make case for ‘real’ farmers

A joint committee set up by the House of Representatives after a motion sponsored by James Faleke (APC, Lagos), called for the investigation of the alleged revenue leakages arising from various unethical practices by banks, international and local oil companies operating in the country.

During his debate on the motion, Faleke said, “There is the urgent need to rescue the country from over $30b annual revenue leakages arising from tax evasion, malpractices, misuse and diversion of foreign exchange allocations by companies and other entities.”

When the House passed its resolution, it mandated its Committee on Banking and Currency, as well as that of finance, to jointly carry out the investigation.

Deliberating on the resolution, members noted that other infractions were committed through malpractices in foreign exchange allocation to companies, from sources such as the Central Bank of Nigeria (CBN), Interbank, domiciliary and over-the-counter purchases for importation of physical goods, payments of foreign service vendors, dividend repatriation and foreign loans.

The joint committee, chaired by Faleke and Victor Nwokolo (PDP, Delta), was mandated to investigate 24 banks and 14 oil companies.

The committee was also told to investigate the disbursement of foreign exchange by the CBN and other agencies, to determine the exact amount government may have lost in the process.

Officials of the banks and oil companies have been invited, and they have started appearing before the committee, which commenced investigation on Monday, July 6, 2020.

The hearing will be conducted in phases; and the first phase is expected to last for three weeks.

The financial institutions invited to appear before the committee, starting from Monday, are Unity Bank, Stanbic IBTC, UBA, Polaris Bank, FCMB, Fidelity Bank, Keystone Bank, FBN Merchant, Access Bank and the Bank of Industry.

Other banks are Jaiz Bank, Coronation Bank, SunTrust Bank, Union Bank, Citi Bank, Guaranty Trust Bank (GTB), EcoBank, First Bank, FSDH Merchant, Sterling Bank, Zenith Bank, Wema Bank, Standard Chartered Bank and Heritage Bank.

On the other hand, the oil companies invited are Nigeria Agip Exploration (NAE), Nigeria Agip Oil Company (NAOC), PAN Ocean Oil Nigeria Limited, Shell Nigeria Exploration and Producing Company Limited, Esso Exploration and Producing Nigeria Limited and Mobile Producing Nigeria Limited.

Others are Statoil Company Limited, Shell Petroleum Development Company, Star Deep Water Petroleum Nigeria Limited and Total E&P Nigeria Limited, Total Upstream Nigeria Limited, Sterling Oil Exploration Energy Limited, Addax Petroleum Development Company Limited and Addax Exploration Limited.

At the commencement of its preliminary sittings, the committee informed that it had sent out invitations to the organisations affected, and sought for documents to be submitted to the committee.

The committee frowns at the refusal of some organisations to respond or provide the information or documents required.

For refusing to honour the committee’s requests, it threatened to issue warrants of arrest on the director of the Department of Petroleum Resources (DPR) and the managing director of the National Petroleum Investment Management Services (NAPIMS).

The committee also disclosed that PAN Ocean Oil Nigeria Ltd, Statoil Company Ltd, Shell Nigeria Exploration and Production Company Ltd, Pipeline and Product Marketing Company (PPMC), Addax Petroleum Development Company Ltd, Chevron, Sterling oil exploration, Heritage Oil Exploration and a host of others, were expected to submit required documents.

Faleke said several letters had been written to the aforementioned organisations, but they were not honoured.

“The committee has given the organisations seven days to furnish it with details of documents required or face arrest in line with constitutional provision,’’ he said.

During the first day of the first phase of the hearing, which commenced on July 6, Unity Bank, Stanbic IBTC and others made submissions.

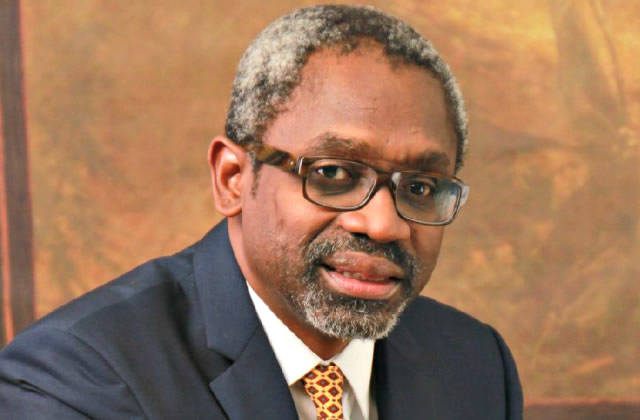

In an opening address during the hearing, Speaker Femi Gbajabiamila said the investigation was part of efforts by the House to fulfill its constitutional obligations in the interest of the country.

He said, “It is unconscionable that we are still losing vast sums of money to avoidable leakages in the system. The House of Representatives has resolved to identify the sources of these leakages and the systemic failures that have either created them or caused them to persist.

We will take the necessary action to propose and implement solutions that will ensure that our country no longer loses these huge sums we desperately need to build infrastructure and support enterprise that creates jobs for our people.’’

Drama as Stanbic IBTC moves to stop investigation

While representatives of other banks faced the committee and responded to enquiries, Stanbic IBTC officials presented a motion from a Lagos High Court, purportedly stopping it from divulging information on foreign exchange transactions to the House of Representatives.

The bank was represented by its country head, Hauwa Bello, head of regulations, Sidesi Alaba and head, operations and compliance, Ngaragu John.

The letter, addressed to the chairman of the committee, stated, “The bank has been served with court process in respect of an action initiated by a class of customers who are opposed to the disclosure of the details of their foreign exchange transactions to the House of Representatives.’’

The letter, jointly signed by the bank’s head of International Business Centre, Olushola Folahan and its executive director, operations, Bunmi Dayo-Olagunju, further reads, “Specifically, the Federal High Court, Lagos division, in suit number, FHC/L/CS/742/2020 by Chief Wale Taiwo, SAN (suing for himself and representing all the customers of Stanbic IBTC Bank PLC who are opposed to the disclosure of their foreign exchange transactions spanning the past 10 years, to the House of Representatives) versus Stanbic IBTC Bank PLC, the Speaker, House of Representatives and House of Representatives Joint Committee on Finance and Banking and Currency, issued an Order dated June 25, 2020, restraining our bank from submitting or disclosing any document, record or other information whatsoever relating to the banking, particularly foreign exchange transactions of the referenced customers to any committee or sub-committee of the House of Representatives, pending the determination of the Motion on Notice.

The said Motion on Notice is now scheduled for hearing on July 8, 2020. Kindly find attached for ease of reference, a copy of the said order.’’

But Faleke said the committee was empowered to invite individuals, corporate bodies and government agencies to carry out investigations.

He alleged that the bank initiated the litigation to stall the committee’s investigation because its lawyer signed almost all the documents it submitted.

“By the time we finish this investigation, Nigerians will know that Stanbic IBTC has something to hide. We have records to show that $30b is lost every year to malpractices and evasion of taxes. It was based on this disclosure that this motion was moved for the investigation to be done, and letters were written to banks.

We want to plead that if the banks have nothing to hide, they should respond to our letters and submit all the required documents, failure of which, of course, as mentioned by Mr Speaker, the committee will be forced to use constitutional powers available to it.’’

More banks were invited on the second day and more are expected in the coming three weeks.

As the hearing gains pace, there are expectations that the committee would uncover what is really wrong.

When the committee is through with the banks, it will be the turn of oil companies to give account of the part they played in the alleged revenue leakages over the years.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.