Reactions have trailed the proposed plan by the federal government to explore pension funds in bridging the infrastructure deficit in the country.

Pension funds, according to data from the National Pension Commission, stood at N19.66 trillion at the end of March 2024.

The Minister of Finance and Coordinating Minister of the Economy, Wale Edun after the Federal Executive Council meeting on Tuesday hinted at plans to tap into pension funds as part of efforts to bridge the housing deficit.

However, checks by Daily Trust showed that guidelines from the National Pension Commission on investible instruments for pension funds do not make provision for the federal government to take pension funds, however, they can only invest it in approved securities.

- Displaced traders of Jos market appeal for compensation

- ‘Nigeria will end insecurity if given 1% of support EU offers Ukraine’

The instruments/asset classes that qualify for investment by pension funds included quoted ordinary shares of publicly listed companies, FGN/State/LG Debt Securities approved by SEC.

Others are money market instruments, which include fixed deposits, tenured placements and bankers’ acceptances issued by financial institutions and commercial papers issued by corporate entities, open/closed-end and hybrid funds including real estate investment trusts and exchange-traded funds) which are specialist/managed investment funds that invest in securities.

Speaking to Daily Trust, a development finance expert, Musa Ibrahim said the six different categories of investible funds as outlined by the National Pension Commission make it clear which funds can be invested using pensions.

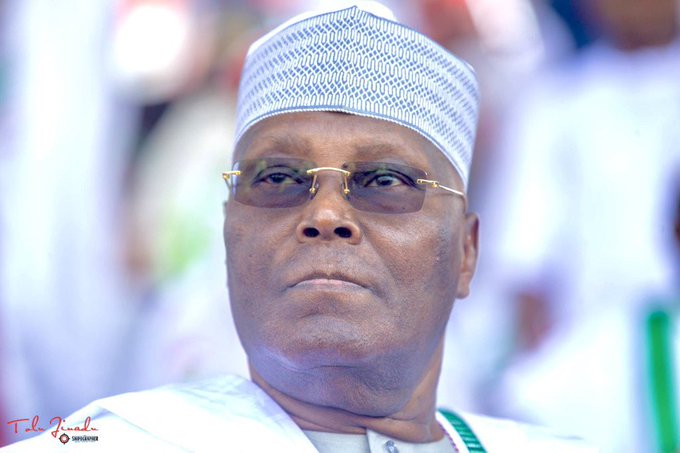

“It is also the prerogative of the pension fund operators to either invest in the particular item the federal government is proposing or not because they cannot be forced,” he said. Also commenting on the issue on his X handle, the presidential candidate of the Peoples Democratic (PDP) Atiku Abubakar said “There is no free Pension Fund that is more than 5% of the total value of the nation’s pension fund for Mr. Edun to fiddle with.

“There are no easy ways for Mr. Edun to address the challenges of funding infrastructure development in Nigeria. He can’t cut corners. He must introduce the necessary reforms to restore investor confidence in the Nigerian economy and to leverage private resources, skills, and technology.”

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.