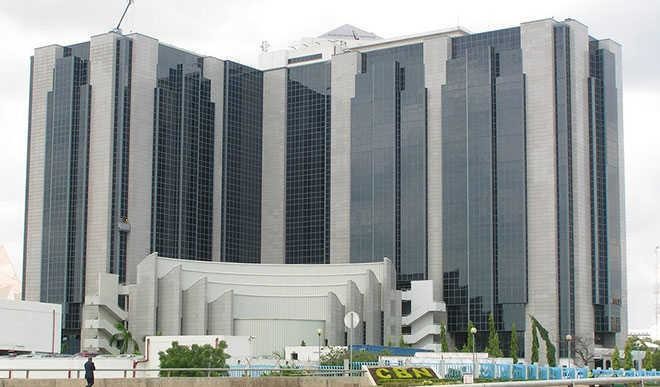

Worried by the increasing spate of naira abuses across the country, the Central Bank of Nigeria (CBN) is taking definite steps to end the menace.

It’s a common sight that you find naira notes strewn with oil, paint, pen ink and or cello tape and almost all denominations of the naira currently in circulation, especially the small ones, have these elements. But particularly worrisome is the trading in naira in Nigeria.

A nation’s currency, like its flag, it’s it symbol of identity thus in most climes, your currencies are well cherished and kept tidy.

In the face of these abuses, the CBN has warned that the abuse of the naira violates extant regulation thus violators, if caught will face the law.

Speaking recently at the CBN’s 2018 International Museum Day celebrations, the Deputy Governor, Corporate Services, CBN, Mr Edward Adamu said the Naira “as it is a symbol of the nation’s identity and pride” must be handled with care.

“The Naira as a symbol of our national pride should not be sprayed or step on, should not be squeezed, defaced or stained. The naira should not be sold or counterfeited” he said.

The Deputy Director, Currency Operations Department, Mr Vincent Wuranti said that the way and manner Nigerians handle the Naira, also affects its life span.

“A lot of thought was put into the design and production of the nation’s currency, thus the need to have respect for the currency” he noted.

He reminded Nigerians that Section 21 of the CBN act of 2007 stated that “the offender must pay nothing less than N50,000 or jail term of six months or both while Section 20 (4) of the CBN act 2007 provides penalty of not less than five years jail term for counterfeiting the Naira with no option of fine.”

CBN has moved a step further by saying it is introducing the mobile courts to try naira abuse offenders.

Recently in Lagos, the Central Bank of Nigeria’s (CBN) and the Bankers Committee to establish mobile court to try offenders and sentence them immediately.

This move is also in partnership with the Nigeria Police Force and the Federal Ministry of Justice.

This CBN according to the CBN is aimed at reducing the huge costs incurred yearly from minting and replacement of bad notes.

At the recently held Bankers Committee meeting, CBN’s Director of Corporate Communications, Isaac Okorafor, noted that the law had been existing but only needed to be enforced fully with the police and other inter-governmental agencies.

He said: “I also remind you that it is a criminal offence to abuse the naira, which is punishable under the CBN Act 2007 by six months imprisonment or a fine of N50,000 or both when convicted of the sale, spraying or mutilation of the banknotes.

“CBN is spearheading this enforcement because it is costing the government a fortune to print the currencies. If this is a cultural thing, it should be stopped. If it is a behavioural thing, it should be changed.”

The Managing Director and Chief Executive Officer of FSDH Merchant Bank Limited, Mrs. Hamda Ambah, also said at the meeting in Lagos that that they were putting everyone on notice to modify behaviours and avoid the wrath of the law.

“We will increase awareness on the handling of the currency. We will not want anyone to be caught on the wrong side of the law. Whether the court begins tomorrow or next year, the most important thing is for you to desist from trading in naira and abusing it,” she said.

However experts say, whilst the mobile courts are good, it won’t end the dirty naira notes and naira abuse conundrum in the country. Rather, transactions with physical cash should be de-emphasized and the cash-lite policy deepened.

They content that, electronic payment channels presents the best option and that Nigeria must fully key into the e-payment systems so less cash can b in circulation going forward.

“In most countries, especially the advanced countries, e-payment channels like internet banking, NEFT transfers etc and mobile payments are predominantly used as the modes of payment and this removes pressure on the fiscal cash” said Mr. David Akwu, an ex-banker and a lecturer at the University of Nigeria Nsuka said.

He noted that Nigerian banks and the CBN must invest more in deepening the e-payment and mobile payments platforms in Nigeria even as he commended the CBN for the cash-less programme it launched some years back.

Mr. Benedict Aondover, a public affairs analyst noted that, since cash cannot be completely eliminated from the system, Nigerians should lean to treat the naira with more dignity by keeping the naira properly in a wallet.

He frowned at the culture of squeezing the naira especially by traders and bus attendants. He also tasked the CBN and the National Orientation Agency to step up awareness campaigns nationwide on the proper handling of the naira.

Also commenting recently on the subject matter, Mr. Rislanudeen Muhammad, a banker and the former acting Managing Director, Unity Bank of Nigeria said dirty naira notes in circulation “often leads to frequent production of new notes with attendant cost on the Central Bank.”

“There is need for improved awareness on the implication of improper handling of the notes, easily making them dirty and difficult to handle leading in some cases to rejection their by vendors. Electronic banking will no doubt reduce significantly cash handling and hence saving the Central Bank cost of frequent printing of the naira notes” he noted.

“However, he said “for electronic banking to sustainably help in significant reduction of printing new notes, the risk of card and internet banking fraud need to be mitigated. In so doing, people will be encouraged to handle less cash thereby minimizing potentials of having dirty money in circulation in the first place.”

It is critical to also note that, Nigerians must de-emphasize the use of cash in transactions. Nigerians must embrace, especially the POS for purchases at markets and the purchase of bus tickets. This also removes the risks of losing money to thieves, market fires and others. This would also impact on the frequency of cash handling thus making the naira neater.