Customers of different commercial banks are groaning over excessive charges from their accounts, findings by the Daily Trust revealed.

The financial institutions known as Deposit Money Banks (DMBs) in corporate parlance have reportedly introduced different deductions to increase their incomes, a development that did not go down well with customers.

- Reps to investigate CBN, 24 banks, oil companies over $30bn loss

- CBN expands scope of regional banks

While some customers reluctantly accept stamp duty deduction, others spoken to said that additional charges for maintaining a bank account were unbearable.

A recent attempt by one of the commercial banks to recover three months stamp duty from its customers sparked an outrage, which eventually forced the bank to jettison the effort and reverse the deductions already made.

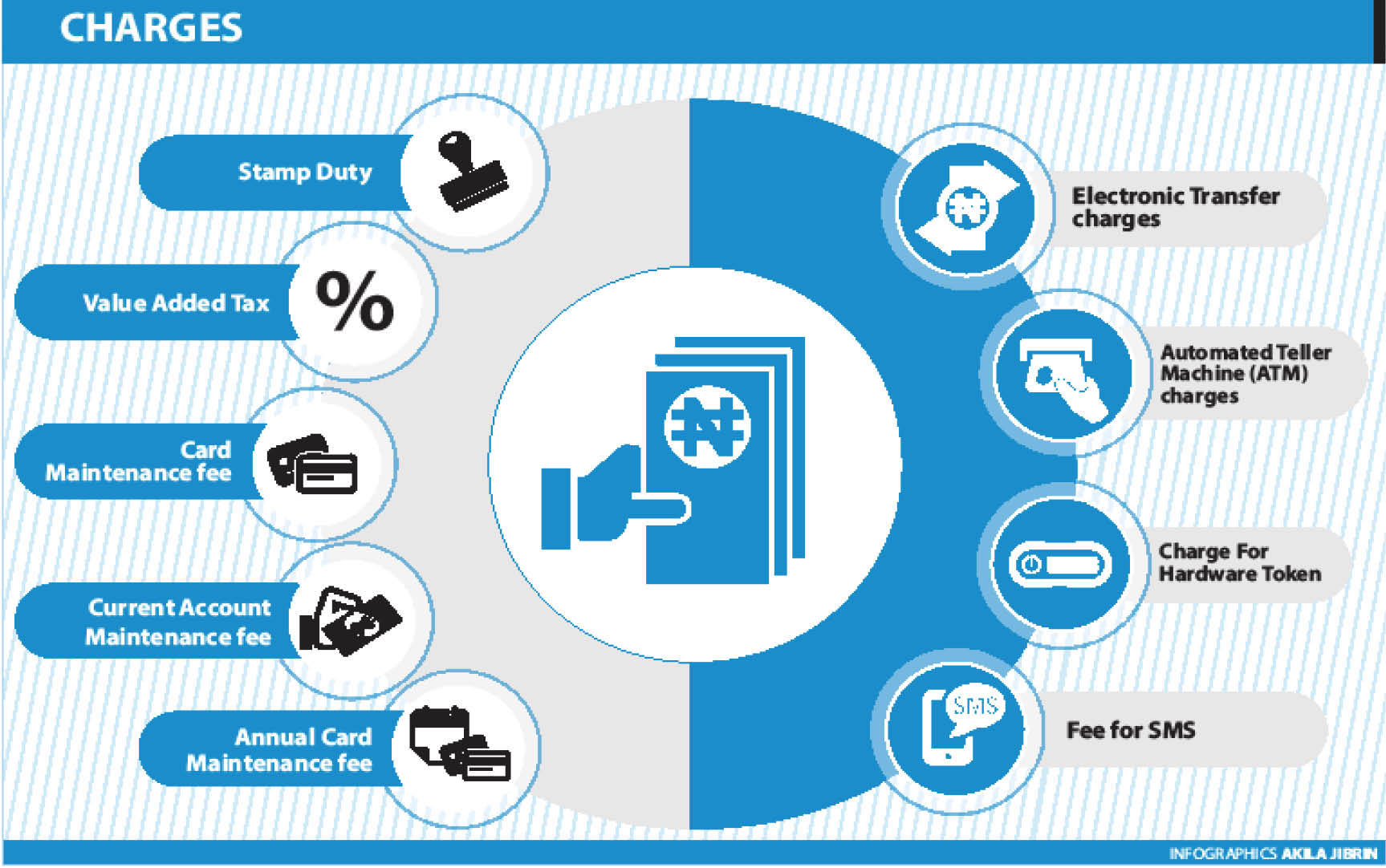

Apart from stamp duty, bank customers also pay Value Added Tax (VAT) charges applicable on all vatable transactions in their account.

The VAT rate stands at 7.5 per cent in compliance with the Finance Act.”

Multiple charges despite government intervention

The outcry by customers is despite the widely celebrated reduced charges applicable to bank accounts, electronic transfers and Automated Teller Machines (ATM) transactions through banks and other financial and non-bank financial institutions in the country.

The revised guide to charges by banks, other financial and non-bank financial institutions released by the Central Bank of Nigeria (CBN) on December 20, 2019, specified a fee scale for electronic transfers to replace the previous flat fee of N50.

The Apex bank noted that transfers below N5, 000 will attract a maximum charge of N10; transfer from N5001 – N50, 000 should attract N25; and transfers above N50, 000 should attract N50.

There is also the Current Account Maintenance Fee (CAMF) applicable to current accounts only in respect of customer-induced debit transactions to third parties and debit transfers/lodgements to the customer’s account in another bank.

The directive removed Card Maintenance Fee on current account as the account already attracted account maintenance fee.

According to the directive, savings accounts should attract a card maintenance fee of N50 per quarter from N50 per month.

It also reduced Annual Card Maintenance Fee on foreign currency (FCY) denominated cards to $10 from $20.

ATM charges were reduced to N35 after third withdrawal within a month from N65.

It said the charge for hardware tokens should be on a cost recovery basis subject to a maximum of N2, 500 from the previous maximum charge of N3, 500.

Fee for SMS mandatory alert will be on cost recovery from previous maximum charge of N4.

Also, bill payment via e-channels should attract a maximum charge of N500 from 0.75 per cent of the transaction value subject to a maximum of N1, 200.

What banks earn recently

A recent computation of earnings from account maintenance charges for 10 of the 14 listed banks on the Nigerian Stock Exchange (NSE) amounted to N22 billion compared to N19.1 billion in Q1: 2019.

The current year has seen a surge of N2.9 billion amounting to an increase of 13.2 percent year on year despite the coronavirus pandemic.

A further breakdown of the earnings revealed that Nigeria’s tier-1 banks, including First Bank, UBA, GTBank, Access Bank, and Zenith Bank generated a total of N18.4 billion from bank maintenance charges in Q1 2020.

The sum is 17.12 percent more than N15.6 billion that was generated by the five banks during the comparable period in 2019.

The other five banks namely FCMB, Stanbic IBTC, Wema, Sterling and Union Bank earned N3.6bn from account maintenance fee.

A further breakdown of the fees revealed that Zenith Bank generated the most income from account maintenance fees, which amounts to N5.7bn; followed by Access Bank, which got N3.9bn and GTBank got N3.3bn.

Others are: First Bank, N3.1 billion; UBA, N2.3 billion; Stanbic IBTC, N1bn; FCMB, N911 million; Fidelity Bank, N735 million; Union Bank, N406 million; Sterling Bank, N394 million and Wema Bank, N270 million.

Customers groan

A civil servant, Victoria Chimezie, said she had lost count of different charges on her account.

According to her, “Whenever money is sent to my account, even if it is N1, 000, I am charged 50 naira.

“It is unfortunate that money is being deducted whether after withdrawals or deposits.”

Aminu Aliyu who deals in foodstuff at Wuse Market in Abuja said apart from deductions after every transaction during the month, he suffers additional deductions at the end of the month.

“While they remove money from accounts after withdrawals or electronic transfers, my bank deducts a lot of money at the end of the month under the guise of account maintenance or VAT.

“I think this is a serious exploitation that must stop,” he said.

Funsho Olojo, a customer of one of the leading banks, corroborated.

“Whenever my bank deducts N50 in the name of stamp duty on a transaction that does not exceed N10, 000, your balance will reflect that N100 or N150 has been deducted.

“That is what I call multiple charges on a single transaction not exceeding N10, 000.

“I have personal experience of this fraudulent practice many times.”

Onyeaka Kelechi Umeh said government and regulatory agencies should rescue Nigerians so that the idea of a cashless economy will succeed.

“I stopped using my savings and current accounts with one of the banks because of their unnecessary deduction,” said Isaiah Ifeanyi Osita.

CBN to the rescue

Daily Trust reports that the CBN had recently recovered some money from commercial banks on behalf of customers.

For instance, CBN’s Deputy Director, Consumer Protection Department, Mrs Chinyere Obilor, during a sensitisation forum organised by the apex bank in Owerri, Imo State, disclosed that they recovered over N60 billion excessive charges on behalf of customers which were imposed on them by defaulting banks.

She said the amount stemmed from over 13,000 complaints, which were received from various bank customers over illegal and excess charges on their account.

In one of its circulars, the CBN said a new section on accountabilities/responsibilities and sanctions regime will address instances of excess, unapproved and/or arbitrary charges by commercial banks.

According to the CBN, financial institutions should note that any breach of the provisions of guides in relation to deductions carries a penalty of N 2,000,000 per infraction or as may be determined from time to time.

Also, the Chairman of the Federal Inland Revenue Services (FIRS), Muhammad Nami, had during the inauguration of the inter-ministerial committee on audit and recovery of back years stamp duties, said: “We have collected and remitted a total of N20 billion from money deposit banks this year alone.”

However, some experts said unless more measures were taken, complaints by customers might skyrocket in the coming months considering the recent data by the Nigeria Interbank Settlement System (NIBBS), which revealed that bank accounts in the country have increased by 35 million between January and May 30, 2020.

The data indicated that the total number of bank accounts grew from 125 million in January to 160 million at the end of May, representing a growth of 78.1 per cent.

Savings accounts grew by 33.8 million in the five months period, moving from 96 million in January to 130 million in May. Current accounts, however, witnessed a drop of 108,000 accounts between January and May.

The total current account in January was 25.2 million, but it dropped to 25.1 million.

How to avoid multiple charges

A banker who gave his name as Joseph Enenche said deduction is the product of the total amount of debit transaction or withdrawals on your account at a given interval.

“What this implies is that your account should not be charged if there is no withdrawal either electronically via instant transfer or online; or physical withdrawal with your cheque in the banking hall.

“If you continue to build your account balance without making withdrawals, your account will not be charged AMC,” he said.

On why banks introduced different charges, a Professor of Finance and Capital Market at the Nasarawa State University, Keffi, Uche Uwaleke, said: “The traditional and major revenue line of commercial banks is interest charged on loans.

“Unfortunately, many banks seem to have derailed from making loans available which is at the core of financial intermediation.

“They now engage in other ventures including activities that are unwholesome such as forex sharp practices, excess charges and all manner of illegal deductions on customers’ accounts.

“This should be frowned at as it demotivates bank customers and discourages financial inclusion.”

According to him, “The fact is that incidence of excess charges and illegal deductions is even more pronounced with corporate and government accounts especially when they are not subjected to close monitoring by the company or state officials.

“The truth is that the CBN has published approved charges with respect to bank services and to be fair to the banking regulator, its consumer protection department promptly sanctions any bank reported to be in breach.

“I am aware that a lot of money has been recovered and returned to customers.”

“I think stiffer sanctions on culprits are required to serve as a deterrent.

“Many banks are profiting from the practice and would pay any fine easily only when exposed than discontinue the illegal practice.

“I also think the CBN’s consumer protection department should pay more attention to preventive than curative measures,” he said.

He also advised bank customers to know their rights and voice out whenever the need arose.

“Customers should periodically demand for their statement of accounts and to promptly escalate any complaints to the consumer protection department of the CBN through the formal channel as stipulated in the complaint procedure on the website of the apex bank,” he said.

How banks could improve revenue base

Also commenting, a top banker who prefers anonymity, said: There are charges that customers can avoid.

“For example, SMS alert. You can decide to say you want only email which is free. Some banks are even trying to link text messages via WhatsApp which may be free.

“But I know some banks may not want it because they are making money.

“Sometimes back, the CBN abolished commission on turnover (COT) but the banks have now introduced account maintenance charges, which is the same as COT.

“The way the customer can avoid it is maintaining a savings account if you don’t have business with a current account.

“You can transfer with savings; savings accounts shouldn’t have maintenance charge,” he said.

On how the banks could improve their incomes without relying on needless charges, he said investments in retail banking and loans remained the best options.

He also said they should invest in technologies to increase their customer base.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.