Many of the 36 states of the federation have increased their budget proposals for the year 2022 compared to what they spent in 2021, findings by Daily Trust have revealed.

Most of the states jacked up their spending prospect amid cash crunch and debt burden, with experts calling for caution.

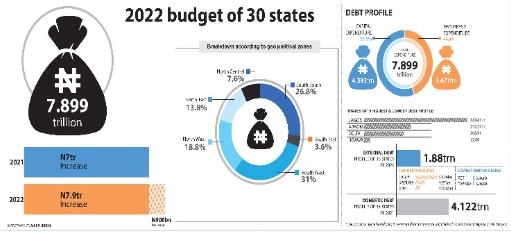

Our correspondents report that 30 states that have so far presented their 2022 budget estimates to their Houses of Assembly have a total of N7.899trn, up from the N7.0trn they budgeted in 2021.

This difference amounts to a N900bn increase, which represents 11.4 per cent increase.

The findings also revealed that only three states can effectively fund their budgets without “big push” from the federal government.

According to BudgIT’s state of states report 2021, only Lagos, Rivers and Anambra can fund their budgets without much trouble.

BudgIT is a Nigerian civic organisation that applies technology for citizen engagement with institutional improvement to facilitate societal change. It also provides social advocacy using technology.

The agency said Lagos, Rivers and Anambra states appeared at the top of its ranking because “they meet their operating expenses obligations with a combination of their Internally Generated Revenue (IGR) and Value Added Tax (VAT).”

In contrast, it said others needed to do more to rapidly consolidate on ongoing strategies to improve their IGR, and by extension their viability as federating entities.

BudgIT said, “This is necessary considering the comparative size of their operating expenses and the global push to transition away from fossil fuels like crude oil, a key source of the federally distributed revenue.”

The agency said states at the bottom of the ranking include Jigawa, Delta, Benue, Taraba and Bayelsa.

It noted that, “Nevertheless, all Nigerian states still need to work hard to build economic prosperity and create more jobs in their states to ensure that there is more money in circulation and economic activities that can be taxed to improve their IGR.”

Some economists and pundits have opined that while it was not wrong to borrow, the major problem was the utilisation of such resources for the benefit of the people.

They contended that bailouts given to the states and huge loans obtained were largely misused and therefore called on the Houses of Assembly to scrutinise the budget proposals before approving them.

Race against bleak income

The income generation indices are not that bright for most of the states despite their plans to increase their expenditure in the coming year.

Analysis shows that the states have a huge debt profile and low IGR, but they hope to get funds from bailouts to achieve their plans.

A review of the states’ fiscal health in 2020 using key metrics: the ability of the states to meet their operating expenses with IGR and VAT and their ability to cover their operating expenses and loan repayment with their total revenue indicates that only three states can meet their operating expenses obligations with a combination of their IGR and VAT.

As of June, 2021, 35 states and the Federal Capital Territory (FCT) owed a total of N4.122trn as domestic debt, according to the Debt Management Office (DMO).

Rivers’ debt profile was not updated, but it owed N213.167bn as of March, 2021. The FCT had a N52.712bn debt profile as of June, 2021.

The breakdown shows that Lagos is leading with N533.81bn, Akwa Ibom is next with N242.27bn and Delta with N205.91bn debt profile in the first half of this year. The lowest indebted state is Jigawa with N32.60bn.

The DMO has not released data for external debt for the states and the federal government this year.

However, as of December, 2020, the 36 states and the FCT had a $4.61bn debt profile.

The largest chunk of this loan was from multilateral agencies like the World Bank which amounted to $4.31bn. Top of the debtors are Lagos ($1.26bn), Kaduna ($551m) and Edo ($280m). The lowest debtor state in terms of external debt is Taraba with $20.80m external debt profile as of last December. The FCT had $30.10m external debt during the period.

How states will fund spending

Reports have shown that some of the states are banking on improved revenue to fund their planned spending. More so, in November, the Federal Ministry of Finance, Budget and National Planning, announced that within six months, the federal government would release N656.1bn as bailout bridge facility to the states to cushion a planned deduction of the N614bn Budget Support Facility (BSF) to the states that was due for repayment in 2019.

The federal government also recently announced that it had planned with the World Bank to provide another $750m (after they got the initial fund) as additional financing for the states under the State’s Fiscal Transparency, Accountability and Sustainability (SFTAS) programme.

In terms of IGR, like VAT, reports show that the 36 states and the FCT collected just N1trn VAT between January and August, 2021, with Lagos collecting N421.2bn or 41.4 per cent of the total sum, while Zamfara recorded the lowest VAT performance of N762.5m or 0.08 per cent.

The National Bureau of Statistics (NBS) said the 36 states and the FCT recorded N849.12bn in IGR in the first half of 2021.

Using Kano as example, Daily Trust on Sunday reports that Governor Abdullahi Umar Ganduje who presented N196.3bn as total budget proposal for the 2022 fiscal year to the House of Assembly said the total recurrent revenue to be collected was N146.8bn.

He said N33bn would come through IGR and N37bn from VAT, while the state would still depend majorly on statutory allocation, which was estimated at N68.2bn.

While the total proposed expenditure is N196.3bn, capital expenditure will gulp N107.8bn and recurrent expenditure is proposed at N88.4bn.

He said education would get the largest share with N51.6bn, representing 26 per cent, while health would get N15bn.

The Chairman of the Kano State Internal Revenue Service (KIRS), Abdurrazak Datti Salihi, had earlier explained that the state would make effort to ensure an upgrade in its IGR.

Salihi explained that one of the efforts was to enact a law in the state assembly to centralise the system to enable only KIRS to collect taxes in the state as against the present system where both state and local governments collected taxes.

He said another measure to boost the state’s IGR was by taking defaulters to court, noting that at the moment a lot of big companies owed the state billions of naira as outstanding tax.

Salihi said, “Just a few months ago, KIRS had to seal some bank’s branches for same offenses.”

Experts caution against wastage

Reacting to the plans by the states, experts said with financial discipline, some states could reduce their propensity for borrowing and achieve a lot.

Umar Salisu, a financial expert, said it was good for the governors to be ambitious, but that they should spend more on issues that would have direct impact on livelihoods.

Salisu said, “Relevant information shows that Lagos, Rivers and Anambra can do much from IGR and VAT. Of course, Lagos has the largest economy because of the ports and the way it collects taxes from companies.

“Rivers is also doing well in this regard and therefore the need for other states to learn from them.

“Sadly, most of our governors spend much of their budgets on recurrent expenditure instead of diversifying their economies.

“I expect them to spend on industrialisation, agriculture, health, education and security. The snag on spending on security does not mean allocating money for unaccounted security vote. What I mean is that they should create jobs for the youths.”

The Chief Executive Officer (CEO) of the Centre for the Promotion of Private Enterprise (CPPE), Dr Muda Yusuf, said there were multiple dimensions to the challenges of fiscal operations of the subnational governments.

Dr Yusuf said, “There are issues around bloated bureaucracy, too many political appointees, high recurrent expenditure and transparency in government finances. Many of the states can operate with less than 50 per cent of the current workforce and political appointees.”

He noted that for most of the states, the details of government expenditure were often not made public.

He explained that, “What you get are broad headings of government expenditure. The framework for checks and balances are also very weak. For many states, the Houses of Assembly are practically extensions of the executive arm of government. Demand for accountability is practically non-existent. There are no audit reports, no statements of accounts.”

Dr Yusuf, who is a former Director General (DG) of the Lagos Chamber of Commerce and Industry (LCCI), said some states also resorted to very costly borrowing from commercial banks which posed additional burden of debt servicing.

Speaking on a possible solution, Dr Yusuf said the unitary structure of government also concentrated too much power and resources at the centre.

He said, “This also undermines creativity and innovation by the sub-nationals. They have very limited control over resources in their domains. Therefore, there is little incentive to aim for the optimal harnessing of such resources.

“But that is not to diminish the fact that the sub-nationals have not demonstrated sufficient creativity in improving their fiscal conditions.”

A financial economist, Prof Uche Uwalake, in an exclusive chat with Daily Trust, said: “So many states are in financial difficulties. You can count the number of states that can actually survive without federal allocation.

He explained that everything boiled down to prioritization, noting that, “You find a lot of wasteful spending and a lot of leakages at the state level.

“So, when we talk about ramping up IGR, it even begins from plugging leakages because even if you try to increase revenue and there are leakages, the money will still be going away, and that’s what you find in many states today.”

Also speaking on the viability of the states, Gabriel Okeowo, CEO of BudgIT, said, “A critical first step for states would be to rapidly block financial leakages that could further drain the little available revenues or future revenues.”

Overview of proposed spending

Four states, Lagos, Delta, Akwa Ibom and Rivers, account for N2.9trn, translating to 37 per cent of the total budget of the states, which is bigger than the budget of each geopolitical region.

The total budget of the above four states dwarfs the total budget of 19 states put together. Sokoto N188bn, Kano N196bn, Kebbi N189bn, Benue N155bn, Gombe N154bn, Taraba N146bn, Kogo N145bn, Plateau N106bn, Jigawa N177bn, Yobe I64bn, Anambra N141bn, Ekiti N100bn, Adamawa N163, Bauchi N195bn, Niger N198bn, Zanfara N160bn, Ebonyi N148bn and Ondo N191bn.

20 states to spend more on capital expenditure

The analysis further revealed that a total of N4.393trn will be expended by the states on capital projects, representing 55.6 per cent of the total budget.

The sum of N3.471trn will be expended as recurrent, which represents 44.4 per cent.

However, 10 states have proposed to spend more on recurrent expenditure than capital expenditure.

Capital expenditure is money spent by government to acquire or build fixed capital assets, land or intangible assets. It includes the state’s investment in projects like the building of schools, hospitals, roads or buying security equipment.

Recurrent expenditure on the other hand consists mainly of expenditure on wages, salaries, supplements and purchase of goods and services.

The 10 states with more recurrent than capital component in their budget include Kogi N90.1bn (N55.7bn capital); Benue N98.7bn (N56.8bn capital); Yobe N91.4bn (N72.6bn capital); Ondo N102bn (N79.6bn capital); Adamawa N98.8bn (64.7bn capital); Bayelsa N199bn (N111bn capital); Plateau N76.2 (N30.8bn capital); Taraba N78.7bn (N68.7bn capital); Ekiti N60.6bn (N40bn capita) and Ogun N180.7bn (N170bn capital).

Breakdown according to geopolitical zones

The South South states, with the exception of Edo, which is yet to propose its budget estimate, account for a total of N2.121trn, representing 26.8 per cent of the total sum.

Akwa Ibom has the biggest budget of N582bn, followed by Rivers with N483bn and Delta with N469bn. Cross River has proposed N276bn.

The South East has a total N289.9bn, representing 3.6 per cent of the total sum.

The breakdown for the region shows that Anambra has proposed N141.9bn and Ebonyi N148bn. Enugu, Imo and Abia are yet to present their 2022 budgets.

The six states in the South West have a combined budget of N2.455trn, representing 31 per cent.

Lagos has the highest with N1.388trn, Ogun N350bn, Oyo N294.5bn, Osun N129.7bn, Ondo N191.6bn and Ekiti N100bn.

The North West has a total of N1.483trn, which translates to 18.8 per cent.

Katsina has the highest provision with N340.9bn, Kaduna N233bn, Kano N196bn, Kebbi N189bn, Sokoto N188bn, Jigawa N177bn and Zamfara N160bn.

Similarly, all the states in the North East have proposed their budgets for 2022, totalling N1.090trn, representing 13.8 per cent.

Borno has the highest with N267.9bn, Bauchi N195bn, Yobe N164bn, Adamawa N163bn, Gombe N154bn and Taraba N146bn.

The North Central has a total of N604.8bn, representing 7.6 per cent.

Niger has the highest with N198bn; followed by Benue with N155bn, Kogi N145bn and Plateau N106bn.

Nasarawa and Kwara have not presented their budgets.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.