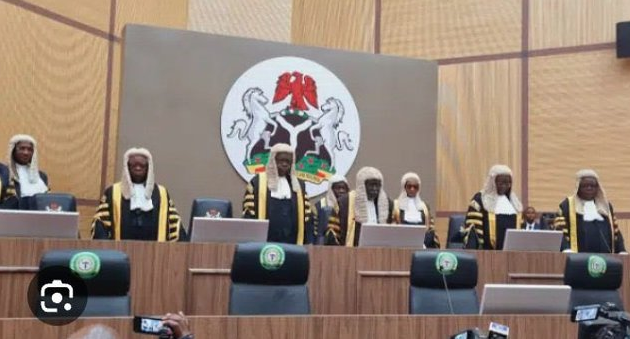

Perhaps as a gauge to how Nigerians felt about the verdict delivered by the Supreme Court dismissing the appeal brought by former Vice President and presidential candidate of the opposition Peoples Democratic Party (PDP), Atiku Abubakar, challenging the eligibility of President Bola Ahmed Tinubu to contest the February 25, 2023, presidential election, there were no overt excitement and enthusiasm about the judgement.

It was not just that many Nigerians had resigned themselves to what they believed would be the outcome, they were grappling with the existential challenges of the harsh economic conditions in the country which were more urgent to them than the legal battles between two prominent figures of the Nigerian political firmament.

On the day the judgement was delivered (Thursday October 26, 2023), the exchange rate was going for N1,200 to the United States dollar and N1,500 to the Pound Sterling and something in between for the Euro at the unofficial markets. At the filling stations and other official outlets, petrol, diesel and cooking gas were inching towards N700, N1,000 and N1,500 per litre respectively, making the products out of the reach of what is left of most middle class families in the country.

All this is a consequence of the removal of subsidy on petrol and the merger of the exchange rates which President Tinubu announced in his inaugural address to the nation on May 29, 2023. As he indicated in his address, he took the decision in order to remove the observed structural distortions in the economy which had led to misapplication in scarce but much needed resources, discouraged investments and stifled incentives for growth.

FG moves to facilitate speedy delivery of attack helicopters to NAF

FG, Chinese consortiums sign N365bn contract to upgrade distribution lines

If that was the intention in theory, in practical terms, however, it has produced the opposite effect. The cost of petroleum products has added to the energy costs of most businesses which in turn have led to higher operating costs cutting into profit margins. Which business will survive when it has to spend one-third or more of its operating costs on energy alone? As expected too, the removal of subsidies has led to spiraling costs in virtually all sectors of the economy and living necessities like food, transportation, services etc. The earning power of the average Nigerian just cannot cope under the present condition and many are now falling into the widening jaws of poverty.

Again, which business can thrive under an exchange rate regime that has suddenly exponentially increased within less than six months by over a thousand per cent and is set to continue to increase by more percentage points in the coming months by all projections? How will a business that made its projections on a given exchange rate with a minus/plus margin hope to cope with sudden rise in the rate and projections for more rises into the coming months?

The effect of combination of these two measures has seen to plummeting fortunes of most Nigerians, closure and reduction in the operations of many business and manufacturing concerns as well even government institutions.

Dire as the situation is now, it is not likely that things will get better. For instance it is not likely that both the prices of petroleum products as well the exchange rate will come down soon if at all thereby prolonging the misery of Nigerians.

President Tinubu must have been persuaded both by his instincts as a businessman and the informed opinion of advisers that this was the right course to take. But from what we have seen of its practical effects, this has engendered more hardships and uncertainty in the land than anticipated. And this has birthed a feeling of not just disappointment but more ominously of a quiet but seething, dangerous angst which the government will ignore at its peril.

Unlike the legal battle which many Nigerians see as a matter whose outcome does not concern them or improve their condition one way or the other, the state of the economy is a matter that concerns and unites them because it is present in their homes, their livelihoods and affects them now and into the future.

From the point of view of most discerning Nigerians, it wwdoes not seem that the measures being addressed by the government either in form of the palliatives announced or in the economic measures contemplated; namely the $10bn that the government hopes to inject into the financial system will go far enough. At best by the reckoning of most Nigerians, the measures will temporarily address the issues but will certainly not bring fundamental and lasting solutions to the challenges. Indeed as some government officials have been heard to lament, the food palliatives in many instances have been allegedly hijacked in many states and the funds approved have been misapplied by chief executives of the states.

So the fundamental question to ask is do we continue on this economic trajectory that promises nothing but more misery and contains the seed of potential social revolt going forward or do we pause, examine the situation critically and consider whether there are options available in which we can as a people and nation tweak the policies for a better outcome in the short, medium and longer term?

More than the battle for legitimacy at the Supreme Court, this is the battle that will define the Tinubu presidency and the future of Nigeria and we must all approach it with the necessary candour and passionate patriotism tampered with realism in the ultimate interest of our dear country. (To be continued).

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.