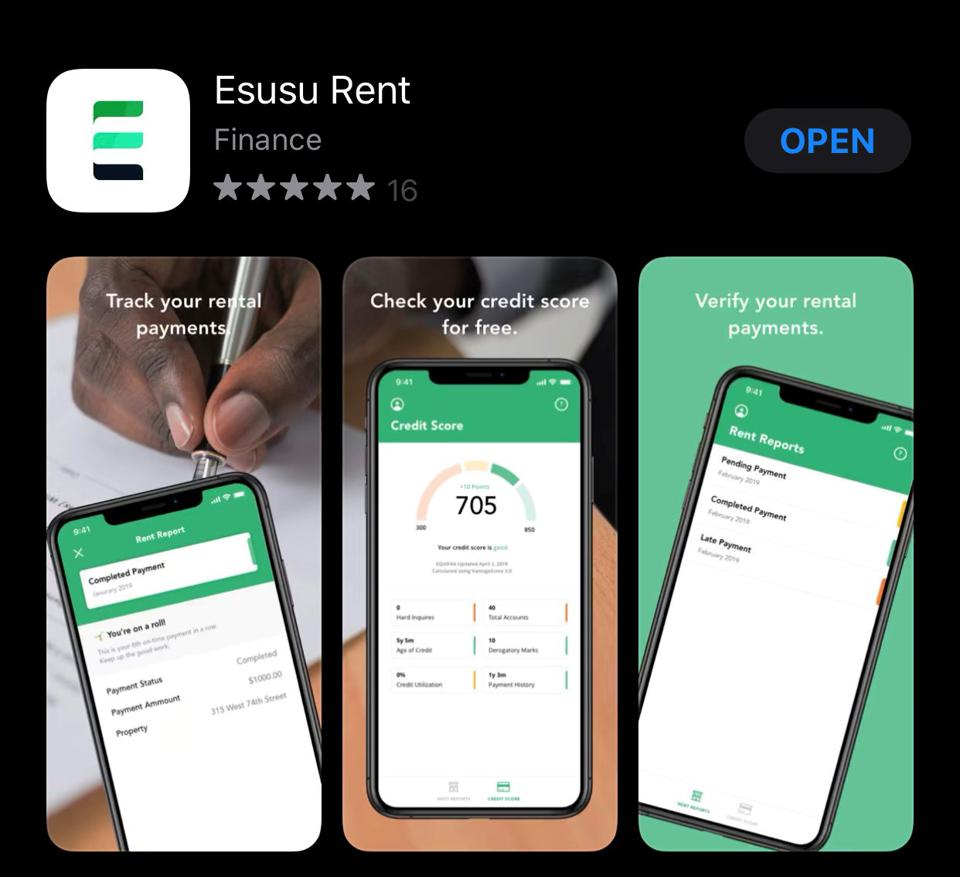

There is an app for everything in today’s technology world. Rotational Savings (Esusu or Ajọ in Yoruba, Adashi in Hausa, and Etoto or Isusu in Igbo) now has its own digital app by the name Esusu.

Thanks to Wemimo Abbey and his Esusu Financial, Inc. co-founder Samir Goel.

UK leads in Islamic fintech ahead of Malaysia, UAE

Again, Nigerian Fintech Start-ups get £80,000 grant

The financial technology (fintech) industry in Nigeria is advanced and could easily become one of the best in the world if it continues to evolve as it has in the past decade.

Incorporating Wemimo’s innovation can only enhance this prospect.

According to Adedamola Agboola of Blackenterpise.com: “Raised by a single mother, Wemimo attended one of the better public schools in Lagos, but he (Wemimo) said he wouldn’t have been able to afford the tuition had his mother not participated in rotational savings.

“Now living in America, the 26-year old wants to help immigrants, students, and low-income families save.”

Esusu Financial describes itself as “a leading financial technology platform helping individuals save money and build credit.”

This enterprise, which was founded in 2016, has attracted some investments, including from Next Play Ventures, an entity that is led by Chairman and former CEO of LinkedIn, Jeff Weiner.

For the most part, Nigeria is still a cash-based economy, meaning that your purchases are mostly done in cash, as opposed to credit.

People pay cash to buy everything, including buying or building a house, even when the cost is in several hundreds of thousands of dollars.

Obviously, money so dispensed cannot be invested to build real wealth, for example, by taking advantage of compounding interests.

Moreover, accumulating capital for all but the low-cost items is hard to do.

Big price items are thus beyond the reach of the average person – everywhere in the world, and particularly in developing countries.

Countries such as the US depend heavily on access to credit to function financially, both at the government and individual level.

Although buying on credit can be undesirable in many situations, and can easily be abused and irresponsibly utilized, there are situations where access to credit may be a lifesaver, as well as the only means of creating substantial wealth.

Fortunately, the Nigerian government has recognized this, though this is a relatively new development when compared to more developed economies like the US.

At any rate, you need to be “credit-worthy” in order to be attractive to creditors.

This is where credit bureaus come in.

These are agencies, such as the CRC Credit Bureau Limited in Nigeria, that collect and research individual or corporate credit information and sell it for a fee to potential creditors, to help them (the creditors) decide whether or not to issue credit.

According to CRC, the data collected on you “captures when a credit account is opened, credit repayment history, the amount of credit you have available, the amount of credit you are using, outstanding debts, details on public records like bankruptcy, tax liens, etc.”

Now, Wemimo and Samir are saying that the financial responsibility embodied in a successful rotational savings (Esusu) arrangement should help you build your credit record and enhance your chances of obtaining credit for bigger price items and wealth creation.

This has not been the case before for people participating in Esusu cooperative financing.

So, this is a useful innovation by Wemimo and Samir.

Let’s look at the traditional Esusu model, to better appreciate the digital innovation.

According to research by Evans Osabuohien and Oluyomi Ola-David from Covenant University, the Esusu practice is believed to have originated among the Yoruba people of Nigeria, and to have spread from there to other parts of Africa, the Caribbean Islands, and among immigrants in the US.

These students describe the practice among the Yorubas as follows: “A group of people team up to contribute a fixed and equal sum of money at specific intervals – daily, weekly, fortnightly, monthly or bi-monthly – enabling each member to collect the entire sum in rotation.

When everyone in the group has benefited from the pool, a new rotation cycle is launched.”

Evans and Oluyomi also point out that “in urban areas, the Yorubas distinguish between Esusu and Ajọ.”

For the latter, a professional collector, the Alajọ, goes around to collect contributions,” and they describe Ajọ – and certainly Esusu – as being more personal than the formal financial system.

Digital Esusu mimics the traditional approach.

To use the platform, your bank account will be linked to the Esusu app, which automatically debits the contribution amount from your bank account on an agreed date.

Reportedly via Evolve Bank & Trust, a Memphis-Tennessee, USA-headquartered bank, Esusu holds the withdrawn money in an account but ultimately wires the sum to the account of the person whose turn it is to collect.

When participants fulfill their contributions, a report is sent to the credit bureaus to alert them that the individual has paid on time, which goes into the individual’s positive credit-building record, as each payment is seen as fulfilling a loan obligation to the group of participants.

Rent payment is usually not reported to credit bureaus, even in the US.

Esusu has changed this for its users that rent, by having their rent payments reported to credit bureaus, again to boost their financial score.

Nigerian credit bureaus can certainly piggyback on digital Esusu.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.