Fiscal and economic development analysts have canvassed the need for a radical review of the nation’s non-oil revenue generation policy frameworks and the current revenue sharing formula among the tiers of government as a logical step to achieving people-oriented development in the post-COVID-19 pandemic years.

The experts, who analysed the nation’s fiscal regimes over the past decades within the context of the COVID-19-triggered shocks in the global oil market and the implications for the country’s sustainable growth were univocal in their views on the imperative of boosting non-oil revenue generation and adopting a new approach in fiscal federalism as the critical options to ending Nigeria’s socio-economic inequality and taming the rising poverty level in the country.

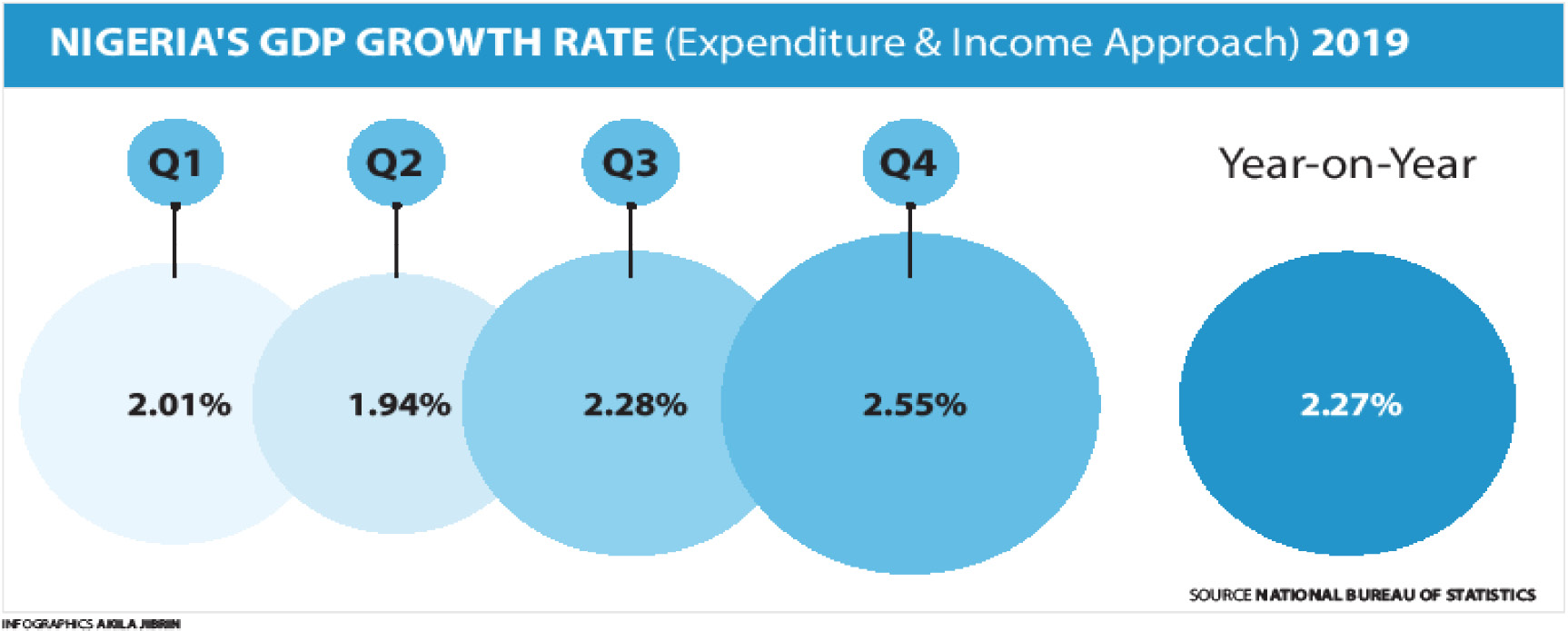

A cursory analysis of the nation’s revenue generation policy regimes for the past decades reflected a lopsided structure with the oil sector accounting for over 90 per cent of Nigeria’s foreign exchange (forex) earnings for successive years while non-oil taxes contribute about six per cent to the GDP growth rates.

More worrisome in the fiscal system template is the lopsided structure of the current revenue sharing formula which, as many experts have pointed out, is not grassroots-oriented in terms of its socio-economic thrusts for national development.

Currently, the revenue sharing formula allows the Federal Government to take as much as 52.68 per cent of centrally-collected revenues, leaving the states and local governments with 26.72 and 20.60 per cent respectively on a monthly bases.

With the COVID-19 pandemic exposing the inadequacies of the current fiscal restructure and dragging the Nigerian economy into a state of near paralysis, a recurring issue in public discourse as experts and other stakeholders in the economy ponder on how Nigeria can wriggle out of the imminent recessionary crisis is the need to optimise the nation’s non-oil revenue generation and giving more of the earnings to the state and local governments.

Although fiscal federalism has been a tough issue in public discourse since the return of democracy in 1999, but no significant progress has been made on it as agitations by sub-national governments for a new revenue sharing formula have yet to enjoy any prioritisation by the National Assembly.

More funds for states will impact positively on healthcare, education and internal security – Dr. Nzekwe

Reflecting on the current fiscal regime and its implications for people-oriented growth, a public finance analyst, Dr. Sam Nzekwe, argued that achieving people-oriented growth in Nigeria requires attitudinal change by the political and entire ruling classes in terms of embracing transparency, accountability and fairness in the way they carry out their responsibilities.

Nzekwe, a former President of the Association of National Accountants of Nigeria (ANAN), lamented that the masses had been so impoverished over the years due to successive mismanagement of the nation’s revenue and other resources to the extent that they were not able to call their leaders to order or demand accountability from them.

He further cautioned that no matter the size of revenue generated in the economy, if the leaders were not ready to embrace the principles of transparency, accountability and fairness in their dealings, the country would find it very difficult to achieve people-oriented growth.

On the way forward on fiscal restructuring and efficiency of the entire system, the seasoned accountant advocated that the country needed to strengthen the procurement processes and build strong institutions of governance, as these would act as catalyst towards achieving people- oriented growth.

The public finance expert further clarified that, “Regarding revenue sharing formula, I suggest that the sub-national governments should be given more funds because the hub of socio-economic activities of the country is situated at that level.

“The current arrangement of the Federal Government taking the lion share of total revenues generated in the economy should be changed to put more funds at the disposal of sub-national governments so that they would be able to fund such areas as education, primary health care, internal security, building and maintenance of road infrastructure within their regions and other critical infrastructure.

“To further boost internally generated revenue, VAT should reside at sub-national levels. Apart from boosting IGR, collection of revenue and implementation of VAT policies will be effectively carried out at that level. All these will aid achievement of people oriented growth.”

Revenue generation-centric strategy, creativity will enhance states’ devt – Dr. Nwani

Commenting on the COVID-19 impact on the public finance system, a public finance analyst and business and investment consultant, Dr. Vincent Nwani, described the pandemic as the single most dreadful threat to the socio-economic fundamentals of Nigeria since independence.

Dr. Nwanni said the scourge had left the nation’s revenue sources from oil, custom duties, taxes, non-oil export, etc. flat and would continue to be so over a foreseeable future.

Nwani, an economist and Managing Consultant of RTC Advisory Ltd, pointed out that as a result of the unexpected shock, the nation’s revenue situation was further exacerbated by huge and growing debt overhang currently at $83bn with annual cost of servicing the debt standing at 45-60 per cent of total revenue over the last five years.

He explained that the COVID-19 pandemic had finally put a sharp and an enduring knife on the national cake that used to bind all the 36 federating states together while also leaving the central revenue basket empty.

To mitigate the impact of the revenue shortfalls at the sub-national level, Nwani advised that state governments must stand up to be counted and commence the process of weaning themselves from the prevalent “feeding bottle” mentality.

He advocated that, “It is time for the states to switch from the age-long spending-centric to revenue generating-centric approach through decisive and homegrown creativity.”

States should leverage their competitive advantages to create wealth – Dr. Sally Adukwu-Bolujoko

A management consultant, Dr. (Mrs.) Sally Adukwu-Bolujoko, has noted that the pandemic had impacted negatively, with governments and individuals globally feeling the economic crunch amid deepening poverty levels and emotional stress and deaths.

Dr. Adukwu-Bolujoko, an industrial relations expert and a former President of the Nigeria Institute of Management (Chartered), pointed out that improving the nation’s fiscal efficiency required refocusing of fiscal policy on “tax stabilisation so as to increase average household income and make doing business easy in Nigeria. It will save jobs and reduce unemployment.”

She said there was also the “dire” need for increased infrastructure development in the area of building new schools to mop up Nigeria’s 15 million out-of-school children, renovate and equip the universities, as well as provide bailout for private schools and SMEs.

Adukwu-Bolujoko, a former member of the Presidential Advisory Council (PAC), further charged government to deliberately invest in research and health facilities and restructure Nigeria to the status of a true federation for the purpose of productive competitiveness, diversification of natural resources and the survival of country.

Recalling that at independence Nigeria operated a system where the regions took 50 per cent of the revenue from their resources and remitted the rest to the centre’s distributable pool, Adukwu-Bolujoko noted that this encouraged healthy competition among regions and incentivised them to keep innovating and creating capacity as economic gain was directly related to work output.

She lamented that the advantage of this system had been eroded by the new system of hand-me-down, largely based on political strong arm, adding that the return to the First Republic fiscal sharing model with some modifications would work and that there should be a re-orientation of Nigerians about the present “handouts from Abuja”, which should no longer be encouraged.

“The regions should leverage their competitive advantages to create their own wealth, and regions with less capacity can get from the 50 per cent remitted to the centre,” the management expert canvassed.

Over the years, efforts by the Revenue Mobilisation, Allocation and Fiscal Commission (RMAFC) to review the revenue sharing formula have failed as powerful political forces have continued to frustrate such initiatives.

She noted that for instance, the RMAFC had during the immediate past administration, concluded a nationwide revenue sharing formula review exercise which spanned over three months and submitted the commission’s report on a proposed revenue sharing arrangement to the then President Goodluck Jonathan for consideration.

She added that up till date, the RMAFC report had remained abandoned at the Aso Villa without anybody giving attention to its recommendations six years after.

Allocating 35% of revenue to FG will catalyse grassroots devt – Prof. Uche Uwaleke

Uche Uwaleke, a Professor of Finance and Capital Market at the Nasarawa State University, said, “COVID-19 is providing Nigeria the opportunity for introspection, including effecting concrete changes in our fiscal federalism arrangements.”

Prof. Uwaleke said the starting point in fiscal restricting should be a review of the revenue allocation formula in such a way that the states take the largest share; which also means they will have more responsibilities.

Uwaleke, a former Commissioner for Finance in Imo State, suggested that a new allocation formula that would give 40 per cent to states, 25 per cent to local government councils and 35 per cent to the Federal Government would be ideal in achieving broad-based development at the grassroots.

The public finance expert clarified on the proposed revenue sharing formula, saying, “With that, responsibilities like roads, and to a large extent, power infrastructure, become the exclusive responsibility of state governments.”

While noting that allowing the states and local governments to share about 85 per cent of the Value Added Tax (VAT) is fiscally logical, the don, however, pointed out that applying the same approach in Companies Income Tax (CIT) collections might trigger uneven development at the sub-national level.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.