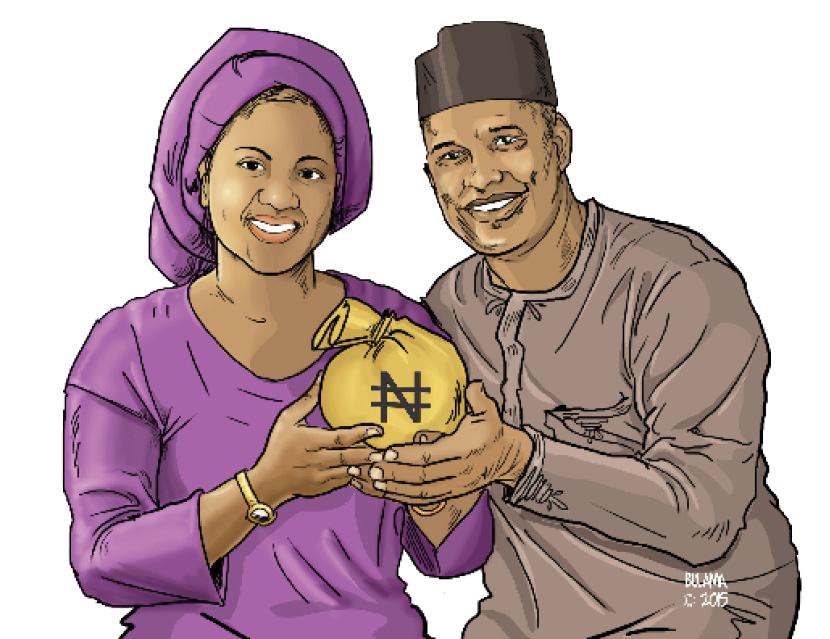

Many homes face financial difficulties when it comes to management of family finances. Whether you are dating or married, addressing the issue of money can be hard.

Money can be a dicey issue for many couples – agreeing on a household budget will inevitably present its challenges if you and your partner have different spending priorities.

Conflicts over money are one of the leading causes of frictions in relationships and divorces for married couples. This is because no one has total control of the family’s finances.

This brings to mind a very pertinent question: “Who should manage the family’s finances?”

LifeXtra went to town to know what people think about it and we got varying and interesting answers.

Adewale Caleb Agbeniyi, a chemical engineer, opines that the wife should manage the finances of the family.

He explained what he meant by “The wife”. “This is because she holds a “double barrel” position in every family. He explained double barrel to be “The chief home administrator and manager.”

Isaac Newtøn Akah, a writer, said he doesn’t mind leaving the financial management aspect to his wife when he gets married.

He said “I am open to leaving that responsibility to the woman I’d marry. This thought would further be reinforced if I discover she plans better than me. By plan I mean, saving and allocation of resources to our needs.”

He added that “I hope we can be very open with our finances.”

Richard Uchegbu however had a different opinion. He said financial management had nothing to do with gender but instead emphasis should be placed on the know-how.

“The issue of managing the finance is a non-gender role in the family. The one who knows better and is financially literate should manage the finance, whether the man or the woman,” he said.

Jummai Austin, a public servant, said “like in everything that has to do with family, I always advocate for the best person to do it.”

“By best person, I mean the partner who is more knowledgeable in that aspect. As such, when I get married if my husband has better financial discipline than I, then of course he will manage it but if reverse is the case, then I will be the one to do it.”

In her article on Psychology today, “Don’t Let Money Ruin Your Relationship”, Terri Orbuch Ph.D. wrote “Find a neutral time to talk money. Couples don’t usually talk openly about money. The goal with your new partner is to have a calm, relaxed discussion when there’s no particular money issue at hand. Sit down with your partner and have what I call a ‘money talk’. Together, discuss different money scenarios and how each of you might address or resolve the scenarios (e.g., overdrawn checking account, fired from a high paying job, lost credit card, the pros and cons of joint or separate checking accounts in a committed relationship, etc.). If you have concerns about your new partner’s spending habits, financial decisions or role in managing money, express those thoughts during this talk as well.”

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.