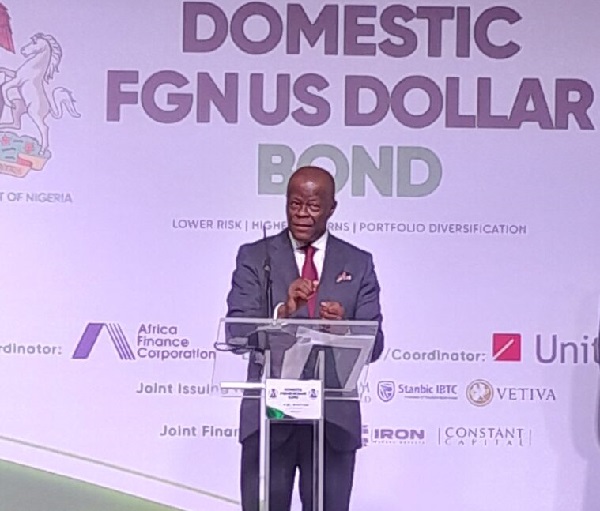

The federal government has officially issued a $500 million domestic dollar bond, opening for subscription on August 19, 2024.

This bond, part of the government’s financing initiatives, will carry a 9.75% per annum interest rate and is set to mature in 2029.

The auction for this bond will remain open until August 30, 2024, giving investors a sufficient window to participate in the offering.

The settlement date, when investors will have their purchases confirmed and interest will begin accruing, is set for September 6, 2024.

- Food security: Caribbean states seek partnership with Nigeria

- Concerns as 43 die of food poisoning in 2wks

The bond is structured as a five-year investment, with coupon payments made semi-annually.

Investors can purchase units at a minimum of $1,000 each, with an initial minimum subscription set at $10,000 (10 units). Subsequent investments can be made in multiples of $1,000.

The bond qualifies as a security under several legal frameworks, including the Trustee Investment Act and the Pension Reform Act, allowing trustees and Pension Fund Administrators to invest in it.

Additionally, it qualifies as a government security under the Company Income Tax Act (CITA) and the Personal Income Tax Act (PITA), offering tax exemption benefits for pension funds.

The bond will be listed on the Nigerian Exchange Limited and FMDQ OTC Securities Exchange Limited, enhancing its liquidity and accessibility for investors.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.