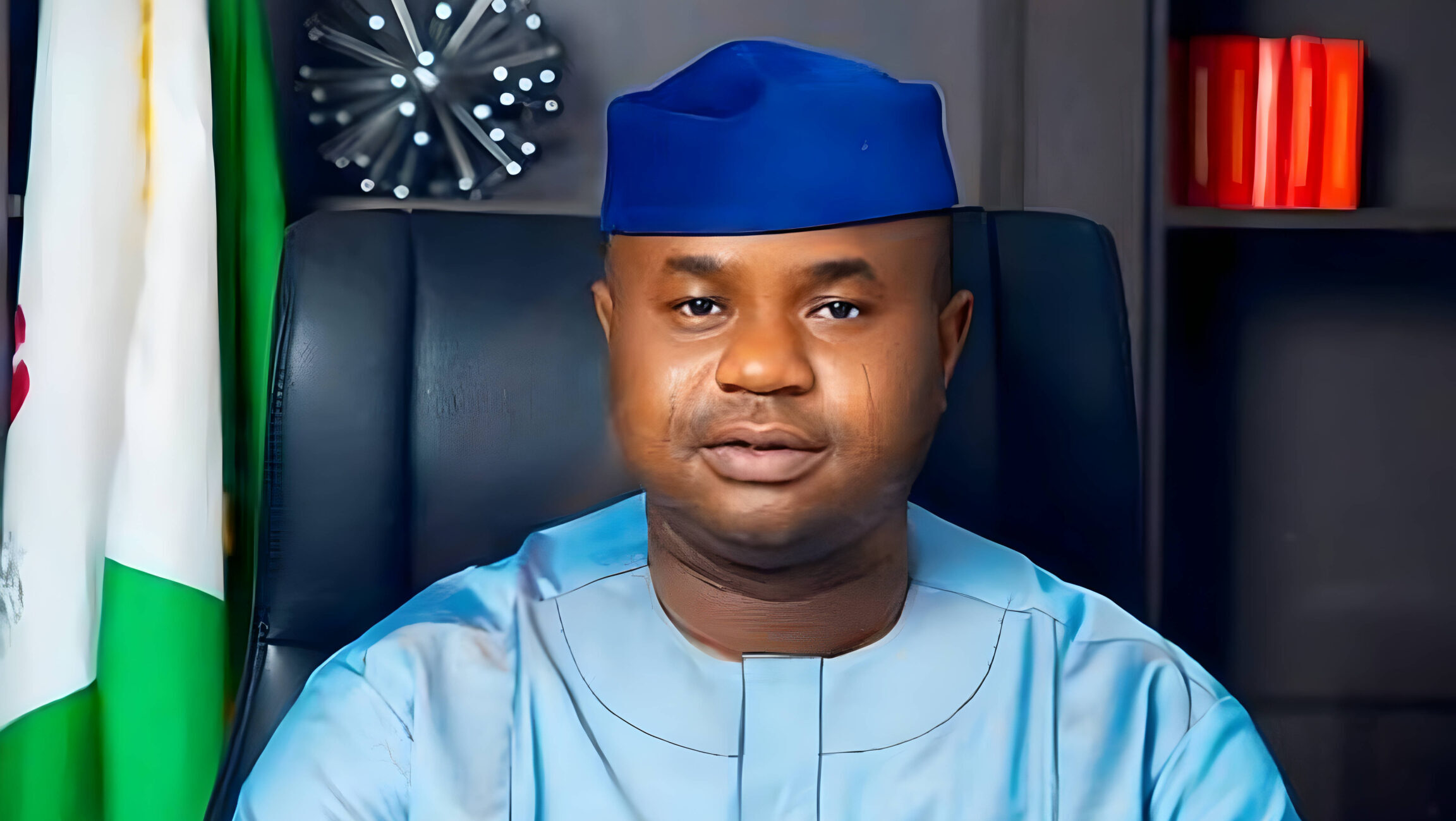

The chairman of the Federal Inland Revenue Service (FIRS), Zacch Adedeji, has charged states to adopt technology in boosting their internally revenue generation capacity

Adedeji, who doubles as the chairman of the Joint Tax Board, made the disclosure on Wednesday in Zuba, Niger State during the 155th Board Meeting of the Board, titled, “Post Reform: Repositioning Revenue Authorities for Effective and Efficient Tax Administration.”

He said, “As government reform initiatives continue to unfold, and as we await the submission of the Presidential Fiscal Policy and Tax Reforms Committee’s final reports, we must begin to look ahead to how the new dispensation can work. At the heart of this are the statutory revenue authorities across the tiers of government.

“Therefore, states must think onward and be innovative in revenue generation drive by answering pertinent questions, such as: How do we position ourselves to exploit emerging opportunities? How do we deal with the “changes” that are bound to occur? How do we manage or mitigate the challenges? How do we leverage technology and the disruptions that digital transformation has laid before us? How do we carry the people along and let them know they are the most essential and critical party in the tax ecosystem? How do we transform the outputs of the reforms and translate them to manifest in shared prosperity that is not only developmentally sustainable but inclusive as well?”

- Senate blames intelligence failure for Borno suicide bombing

- Windstorms render 4,976 Yobe households homeless

Also speaking, the governor of Nigeria State, Umar Bago revealed that between January and May this year, Niger State collected an average of N2.6 billion monthly as against an average of N1.8 billion the previous year. In May alone, we generated N3.5 billion, representing a percentage increase of 45 per cent.”

Represented by the commissioner for budget and planning in the state, Mustapha Ndajiwo, the governor said: “By simplifying processes and leveraging technology, they have made it easier for taxpayers to comply, while reducing opportunities for evasion. This has resulted in improved compliance rates and enhanced revenue collection as the state has set a target of N5 billion revenue collection monthly.”

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.