The proliferation of Fintech companies, many lacking solid financial foundations and competent management, led to frequent financial distress and crisis, partly due to the absence of regulation. The 1952 “Banking Ordinance” was Nigeria’s first attempt to regulate banking activities, ushering in the era of regulated banking.

The banking industry in Nigeria has since gone through several significant or transformational phases, including the Era of Free Banking (1892-1952), the Period of Regulated Banking (1952-1986), the Era of Deregulation (1986-2004), and the Era of Banking Consolidation combined with the Era of Stringent Banking Regulation (2009-2015). 2015 till date as seen the industry change at rapid speed but can broadly be defined as the era of financial inclusion, retail expansion, digitalisation, and corporate responsibility.

Despite various regulatory reforms aimed at improving the banking sector, Nigeria faced severe banking crises in the 1990s. In response, significant measures such as increasing the capital base of commercial banks from ₦2 billion to ₦25 billion in 2005 and implementing strict banking regulations in 2009 were introduced.

These milestones were pivotal in shaping the Nigerian banking system. Nevertheless, one of the Fintech Company that evolved from this crisis, KaboCash Technologies Limited has today become a behemoth, with its sights set on becoming the Africa’s most valuable private startup in Africa around 2024.

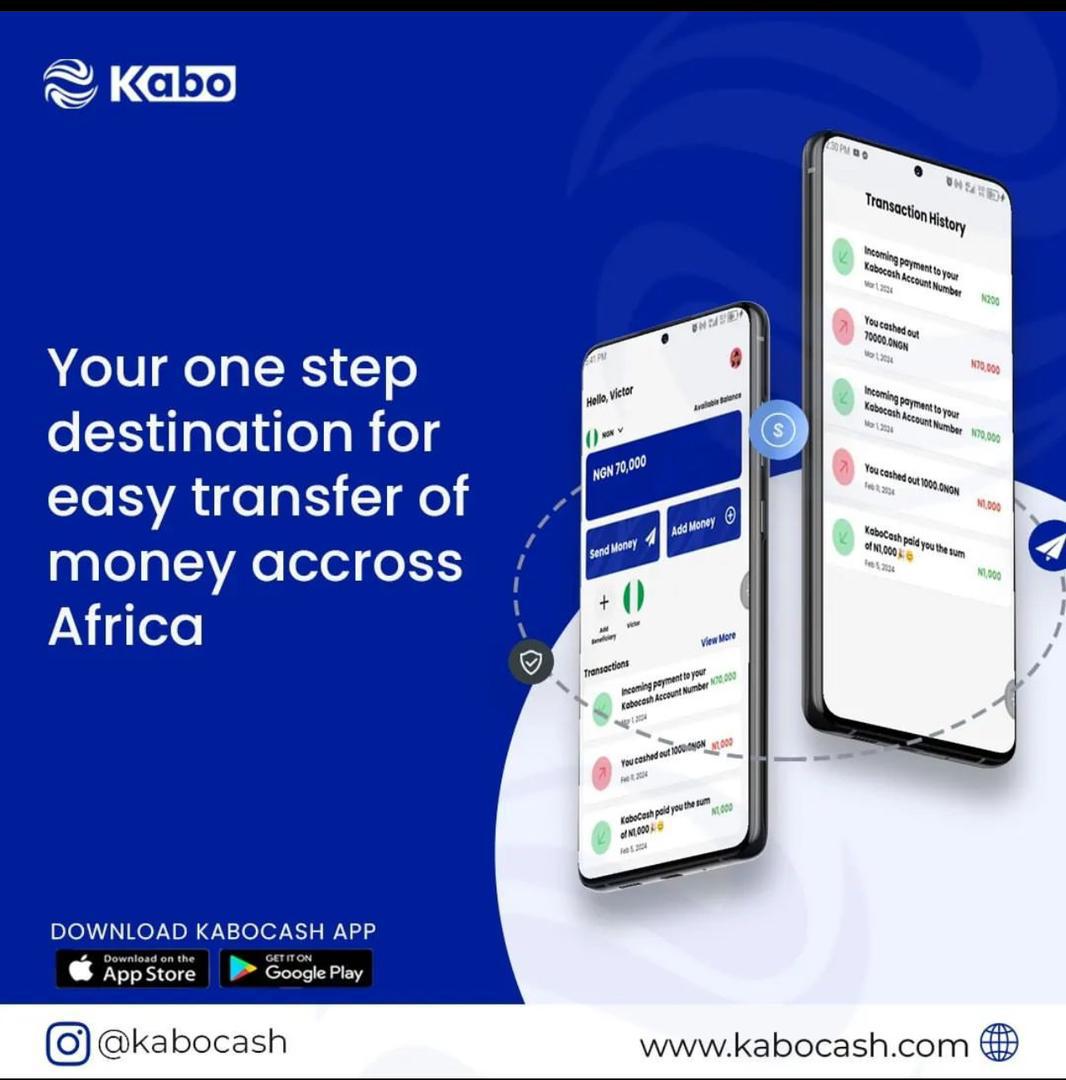

KaboCash Technologies Limited began its operations in February 2024, after obtaining a various regulatory license from different regulators. Initially, it faced challenges as a small player in the African Fintech Sector (AFS).

The resilience of KaboCash Technologies is evident in its early challenges, as between January 2023 and February 2024, the company experienced limited growth as it has been under construction, complying several regulatory measures. As for February 2024 when the company started to operates, Its financial performance was also poor due to the lack of revenue generating opportunities for funding inadequately, providing minimal returns to investors. Despite these early struggles, the new strategy which’d been implemented was determined to turn the tide. Just for recent, KaboCash Technologies announced the raising of $1.2m in just three months, this is well achievement in the history.

KaboCash Technologies also expanded its service portfolio, leveraging relationships with large corporate clients to drive organic growth. Strategic acquisitions also played a crucial role in this transformation.

In recognition of the role of an enhanced capital structure, the company embarked on a capital raising exercise in March 2024. The exercise was an outstanding success recording more than 5 ventures has made the commitments towards this capital raising. From the source, the company disclosed that it’d entered a relationship with FasterCapita which is situated in United Arab Emirates (UAE) for disclosing their Due Diligence Agreement raising over $10m in six months. All the preparations have been made and they signed on the contract.

KaboCash Technologies’s transformation has not only been about growth, but also about setting a benchmark in the Fintech Sector. The company has been at the forefront of digital innovation in this recent, launching various digital products and services to enhance customer experience and financial inclusion.

Its mobile app has made the services more accessible to thousands of customers today, particularly for International Money Remittances, contributing significantly to financial inclusion.

Expanding its footprint across the African continent, KaboCash Technologies now operates in 9 countries. It’s African spread includes a presence in Uganda, Kenya, Rwanda, Tanzania, Cameroon, Ghana, Nigeria, South Africa, and Ivory Coast.

This pan-African strategy leverages the capabilities in trade finance and digitalisation to serve as a gateway between Africa and the rest of the world. KaboCash Technologies also has operational presence in key financial centres such as China, Hong Kong, France, UAE, and the UK, and maximises this to facilitate international trade and investment.

The KaboCash Technologies’s resilience and transformative strategies have translated into robust financial performance and industry recognition.

Just in the recent, the company has consistently reported growth in revenue, profit, and assets. It is now firmly recognised as one of the leading financial institutions in Africa, receiving numerous awards and accolades for its services, innovation, corporate governance, and social responsibility efforts.

Looking ahead, KaboCash Technologies plans to continue it’s expansion across Africa and other international markets, seeking opportunities for growth and innovation. The company aims to further enhance its digital transformation capabilities, focusing on customer-centric solutions and leveraging emerging technologies. It’s one part of the company’s strategy to connect the entirely Africa and beyond.

“At KaboCash Technologies. We are leveraging our technology for making an instant cross-border payments as simple as making a phone call”

KaboCash Technologies, connecting Africa and beyond.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.