The federal government should embark on a gradual phasing out of the petrol subsidy programme, the Nigerian Economic Summit Group has advocated.

This will save the country from the impending fiscal crisis, NESG said in its September 2022 report reviewed key economic developments in the first eight months of the year.

NIMC charges staff on service delivery

Cybercrime: No business is too small to be attacked – CSCS

While acknowledging that the suggestion will affect the welfare of the citizens through increased prices of petroleum products, the organisation noted this will be only in the short run. “On the other hand, the more extended effects of sustaining this programme are disastrous,” it warned.

The suggestion on subsidy removal is part of the group’s policy recommendations to revamp the nation’s sagging economy.

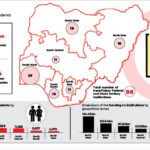

“From the standpoint of fiscal sustainability (solvency and liquidity), Nigeria is gradually approaching a fiscal cliff or trap as the country’s debt service to revenue climbs unchecked currently at 119 per cent of revenue) and debt-to-GDP ratio approaches the 35% weak-risk threshold set by the International Monetary Fund,” it said, noting that the ratio had reached 23.3% in Q1.

Nigeria is currently stuck with a fuel subsidy programme that many consider unsustainable given its negative impact on the government’s budget. Its cost for this year is put at about N4 trillion.

It observed that despite an increase in global oil prices, FG’s actual revenue (N1.63trn for January – April 2022) was short of the prorated budget (N3.32trn), while government spending (N4.72trn for January – April 2022) was significantly closer to the budgeted levels (N5.77trn for January-April 2022).

On the inflationary pressure that is ravaging consumer welfare in the economy, it warned that this will intensify deep into the year with no end to the cause of disruption in the global supply chain.

It also recommended that the authorities should remove the current caps on capital flow. “To address sustainable foreign dominated investment inflows, the government and monetary authorities must remove the existing cap or controls of capital outflows,” NESG said.

The economic think tank also wants the government to improve agricultural productivity, to reduce food import inflationary pressure.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.