By Simon E. Sunday, Philip S. Clement (Abuja), Abiodun Alade, Abdullateef Aliyu, Christiana T. Alabi (Lagos) & Clement Oloyede, Zahraddeen Y. Shuaibu (Kano)

The 774 Local Government Areas (LGAs) in Nigeria can earn enough revenue to stay afloat and remain independent of the state governments if they push further to harness property rate, parks, animal tax, business premise and signage rate, among others.

In spite of these revenue windows, there are concerns by LGA administrators, civil societies and analysts, that the LGAs are at the mercy of governors of the 36 states due to the lack of financial autonomy, causing a deliberate dependence on the states’ coffers to run the affairs of the local government, which is the third tier of the Nigerian government.

Ekiti gov’ship: APC in early lead as PDP, SDP trail

2023: How Kwankwaso, Obi will pinch votes off Atiku, Tinubu

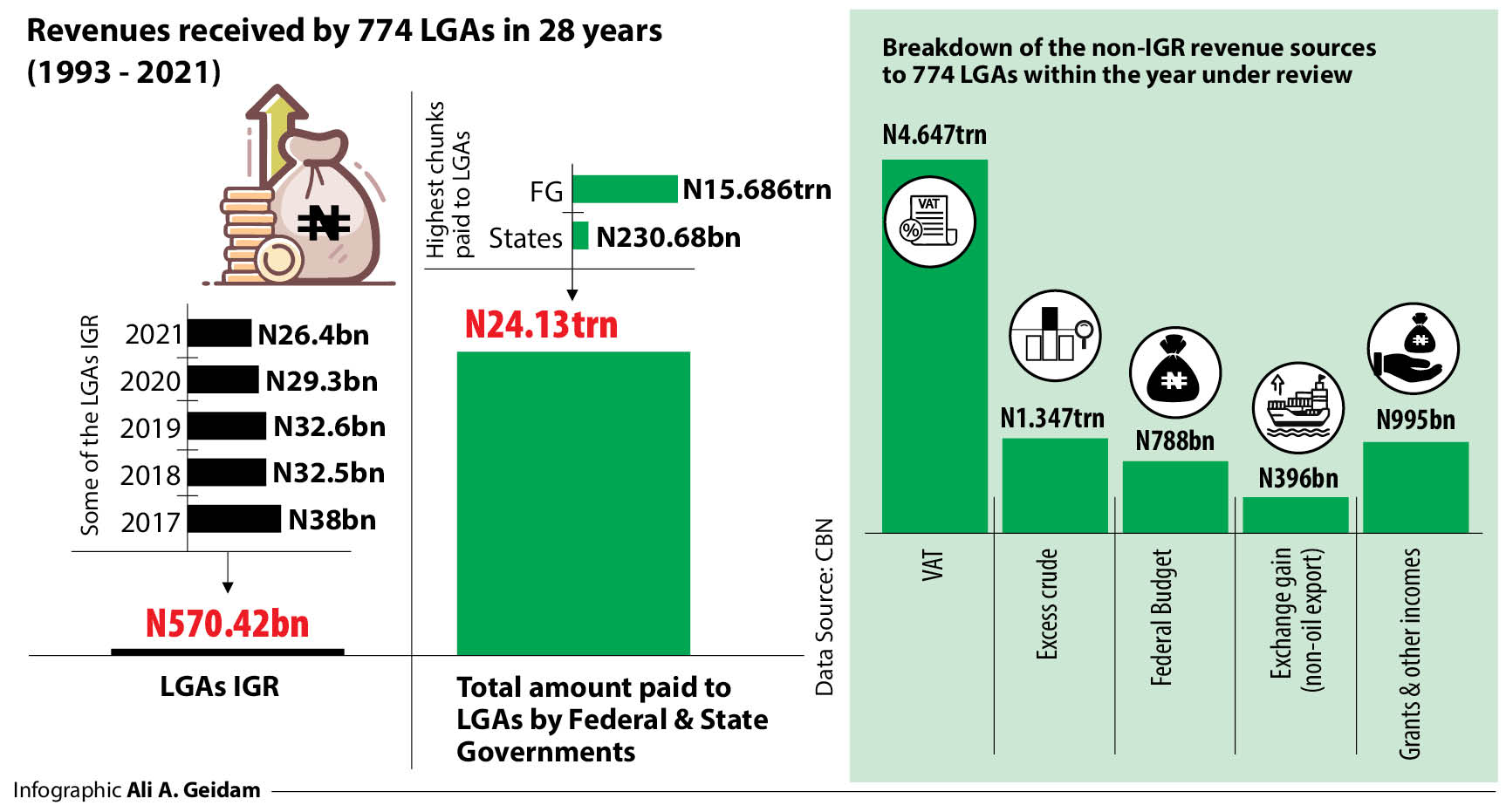

This LGAs’ dependence is portrayed by the Central Bank of Nigeria (CBN) in its annual economic report for 2021 where the 774 LGAs generated just N570.42 billion in 28 years, from 1993 to 2021 as their Internally Generated Revenue (IGR). The federal and state governments gave the LGAs N24.13trn, bringing the total revenue to N24.768trn during the period.

From the N570bn IGR by the LGAs, the highest revenue of N38bn was generated in 2017 but began a sharp decline to N32.5bn in 2018, N32.6bn the next year, N29.3bn in 2020 and N26.4bn last year.

Out of the N24.7trn total revenue for the LGAs, the highest chunk of N15.686trn came from the federation account; they also got N230.68bn as state allocation which was less than 50 per cent of their own IGR.

Further breakdown of the non-IGR revenue sources indicates that the Value Added Tax (VAT) brought N4.647trn; the excess crude fetched N1.347trn for the LGAs; they got N788bn from federal budget, another N396bn came from exchange gain (non-oil export) and N995bn from grants and other incomes.

With more efforts, LGAs can shun states’ allocation

Daily Trust on Sunday reports that the LGAs can actually thrive with their IGR and business initiatives to settle salaries of local government employees and keep the secretariats and agencies running healthily for grassroots development, which is at the core of governance.

The Tax Policy Centre, A US-based financial tracking platform, notes that local government revenue comes from property, sales, and other taxes; charges and fees; and transfers from the federal and state governments. For instance, in the United States, taxes accounted for 42 per cent of the $1.73trn (N718.2trn) of local government general revenue in 2017 which was $707bn (N293.5tr) revenue from property, sales, and other taxes. The income was higher than the 36 per cent that came from the US federal and state governments in one year.

In Nigeria and depending on the states’ laws, popular taxes and revenue sources include, road, motor park, market and trader, quarantine services, road use or congestion, signage, business premises tax, LGA commercial vehicle permits, daily ticketing for commercial vehicles, motorcycles and tricycles.

Beside these revenue sources, the LGAs according to the VAT Act and Finance Act 2020, earn 35 per cent of the VAT collection by the Federal Inland Revenue Service (FIRS), while the federal government gets 15 per cent and the states get 50 per cent.

In spite of these windows, some reports have shown that the LGAs and even sub-councils called the Local Council Development Area (LCDA), in some states, are still not doing enough to raise their IGR and cut over-dependence on the state for funding.

For instance, Budgit, a finance accountability champion in Nigeria, reported in March 2022, that Ikorodu West LCDA in Lagos had N1.35bn revenue in 2020, out of which only N40.37 million was its own IGR as the rest came through joint sharing from the state and federal government.

More so, a CBN 2015 annual economic report indicated that the LGAs had a deficit of N700m contrary to a surplus of N900m in 2014 and they had to finance their expenditure mostly from commercial banks in 2015.

LGAs revenues in Lagos, Kano

Lagos State has 20 LGAs and 37 LCDAs generating revenue through collection of charges from motorists, market traders, land use charge, among others. Last year, Lagos launched the N800 Consolidated Informal Sector Transport Levy Ticket, for commercial drivers to pay 800 daily or N24,000 monthly and N292,000 annually; besides the daily dues collected by the National Union of Road Transport Workers (NURTW) at motor parks.

Other levies in Lagos LGAs come from shop owners and companies, marriage registrations, entertainment, open air event permit fees, social organisations registration and rent on LG properties, among others. The Lagos State Signage and Advertisement Agency (LASAA) also bills for signages.

However, a huge chunk of these revenues is often eroded (through fraud, short-changing by touts or agberos) with less funds in the public record. A staff at the Ikeja LGA, told our reporter that some LGs in Lagos are richer than some states but noted that corruption is high at this level.

Our correspondent also spoke with some LGA chairmen who revealed why they can’t push for more revenue sources. One said many of his colleagues have an idea about developing their LGAs by exploring various revenue sources but they are always conscious not to conflict with states.

In Kano, the Kano State and Local Government Revenue Administration (Codification and Consolidation) Law 2022 stipulates revenue sources: at an abattoir in an LGA, each animal (goat, sheep, cow and camel) attracts between N100 and N200 while a trailer load is N5,000, canter and trucks pay N2,500 and tricycles pay N500.

The signage and mobile advertising fees are jointly collected by the state and the LGA at N3,000. There is also a road congestion charge where tricycle, cars and buses pay N100 daily and tankers pay N200; tippers pay between N200 and N500 while trailers and luxurious buses pay N1,000. Business premise registration renewal in semi-rural and rural areas goes for N2,000 and N5,000.

To enforce the law, it was observed that LGAs recruit temporary tax collectors to stand at the border of each LGA border to collect entry tax that is mostly N50. Notable among the nine metropolitan LGAs is Fagge LGA with the largest number of markets like Kantin Kwari Textile market, Sabon Gari (Yankura) market, Singer, France Road, Beirut Road telephone market, Wapa Bureau De Change market, among others.

A tax collector in Fagge LGA said there are at least eight categories of taxes they collect from markets and shops annually from which the LGA is generating hundreds of millions and creating jobs.

He said, “Some of the taxes are: tenement rate, shop rate, temporary permit, sanitation, trade permit, loading and unloading, parking permit and canopy tax. Although not all people pay the exact amount on the demand notice, we often collect 60 to 70 per cent. Like the sanitation, it is not more than N5,000 but most people usually pay N3,000.”

He said the highest among the taxes that generates more are the Tenement, Shop rate, Temporary permits and Trade permits, earning over N50,000 each. At the Beirut Road GSM market, Shuaibu Jibrin said: “We pay for sanitation but they don’t do that, we have to always remove waste by ourselves and we pay other people to take it to the dump site.”

Attempts to get the Chairman of Fagge LGA, Ibrahim Muhammed Abdullahi (Shehi), to speak on the LGA financial independence was not successful as he did not respond to calls and text messages. Equally, the Chairman of Ungogo LGA, Engr. Abdullahi Garba Ramat, promised to respond to did not as of press time.

LGAs must synergise, create jobs, digitize systems – Experts

The 774 LGAs can significantly improve on their revenue sources to wean themselves off states by synergizing with the private sector, digitizing their revenue platforms, among other innovations, experts argued.

Speaking to Daily Trust on Sunday, a senior economist at SPM Professionals, Paul Alaje, said governments must learn to become self-sufficient owing to the current headwinds the economy is facing.

He said, “The IMF is already warning Nigeria that by 2026, 96 per cent of revenue will now be used to service debt and that is typical of the federal government. When that happens, what will be the fate of states and local governments? This is why the local government must start generating revenue for the purpose of self-dependence.

“Local governments stand a better chance of generating huge revenues from the available window which is the closest to the people, especially from tenement rate and motor parks,” revealed Alaje.

He however noted that using thugs and manual collection means must be discontinued. “Anyone who wants to generate revenue from tenement rate and others must and should be via an electronic means. That is when proper accounts will be kept and I assure you majority of local governments will do triple of what they are doing in revenue. Above all, accountability and transparency should be key to drive revenue generation at the grassroots.”

Also speaking, ECOWAS Chief Economic Strategist, Prof. Ken Ife, said for LGAs to be self-reliant, collaborations and improving manpower is vital.

Ife said: “When we bring the private sector into it, revenue generation will improve, especially at the local government. Also, there is the need for youth and women empowerment, because when you create wealth through empowerment, it is easier to make more money from taxes and other means.”

A Professor of Economics, Ndubuisi Nwokoma, said the monthly federal allocation hardly gets to the LGAs as they are pocketed by the states.

“Their lack of total independence makes them a little bit lazy; they want to please the master, so they overlook a lot of local informal taxes they can actually work on. There are so many local internal revenues that are visible in many states. A lot of local fees and market charges that are within their purview,” he said.

Nwokoma, however, noted that this laziness makes them not to focus on development, adding that “even a little pothole in their LGA, they can’t fix it. They don’t give, they just take from the centre and they don’t generate any revenue because of this attitude of total dependence on the state governors.”

The economist however called for total independence and autonomy for LGAs while creating a check and balance system to prevent LGA chairmen from being autocratic.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.