Despite the surge in the profits of cement manufacturers in the country, the end price of the commodity has continued an upward surge in the last 18 months. This is in spite of assurances by the manufactures that they are increasing production.

Consequently, the rising price of cement is causing a sharp increase in the cost of building development.

- Consolidating liberal, secular democracy in Nigeria

- MTN public shares offer to lift million Nigerians out of poverty — CEO

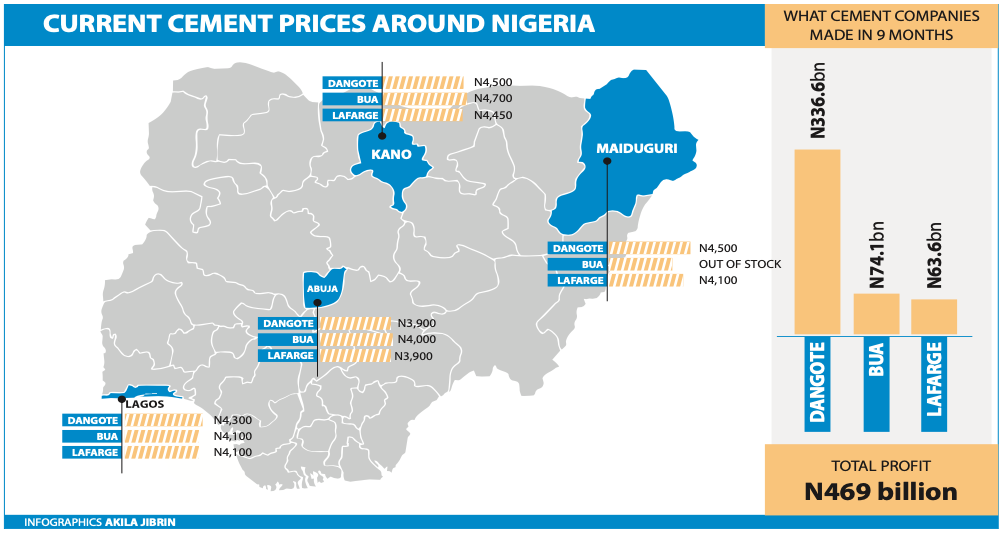

The Nigerian cement market is dominated by three players –Dangote Cement, Lafarge Africa Plc and BUA Cement.

Daily Trust investigation reveals that the price of a 50kg bag of cement initially rose from N2,500 to N3,600 around November 2020.

Currently, there is a huge difference in the ex-factory price of cement and the retail market price.

A wholesale dealer in various kinds of Cements at Okera in Ajah Axis of Lagos state, Adeleke Oluwafemi, said a bag of Dangote Cement was sold for N3,400 from the company while wholesalers sold same for N3,600 within January and April 2021.

The price however shot up later in the year currently selling at the rate of N4,000 while the retailers sell it between N4,200 and N4,300.

Oluwafemi said BUA Cement was sold for N3,600 in the early months of the year but is now sold at the rate of N4,100 per bag.

He added that Lafarge Cement, which was sold for N3,000 before July is now sold at the rate of N4,100.

Another retailer from Gbara Market in Lekki, Sadik Hassan Olugbade, said a bag of Dangote and Lafarge Cement, which was sold for N3,700 each earlier in the year, is now sold for between N4,100 and N4,300.

In the Federal Capital Territory, survey by our reporter shows that a bag of Dangote Cement is sold between N3,800 and N3,900, depending on the location.

Market survey conducted in Bwari, AMAC, Kwali, Kuje and Gwagwalada also shows that BUA Cement is slightly higher as it is sold between N3,900 and N4,000.

Larfage is sold between N3800 and N3900 depending on the location.

One of the cement dealers, who spoke with our correspondent, attributed the high cost of the products to landing costs, adding that there is no guarantee that the price will not go higher any moment from now if urgent action is not taken by the relevant stakeholders

In Kano, Dangote sold for N4,500, BUA N4,700 and Lafarge cost N4,450 for 50kg.

Some of the retailers who spoke to Daily Trust said there has been scarcity of the products in the last few days.

They said they suspect that there is a plan to further increase the price and as such the major dealers may be hoarding the products.

In Maiduguri, the Borno State capital, Dangote sold for N4,500 and Lafarge N4,100. BUA, which has not supplied the product in the last two weeks, last sold for N3,500 per bag.

Senate wants more Cement licences

Worried about the high price of cement, the Senate had in April called on the federal government to provide more industrial incentives for new entrants into the cement business to break the oligopolistic nature of the industry, boost production of cement and consequently result in lower prices.

The Senate noted that the rising price of cement is impeding the ability of the government to provide the needed infrastructure to promote growth.

Last month, Katsina billionaire, Dahiru Barau Mangal, inked a $600m agreement with a Chinese firm, Sinoma, to establish a cement factory in Moba, Kogi State.

Cement coys make huge profit

The trio of Dangote Cement, BUA Cement and Lafarge Cement reported a combined N469 billion profit-before-tax for the third quarter of 2021.

Dangote cement topped the gainers with at N331.6 billion, BUA at N74.1 billion and Lafarge at N63.6 billion for the nine months period.

According to the trio’s nine-month performance, they were able to increase their revenue by 30.10% from N1.1 trillion generated in the nine months of 2020 to currently stand at N1.4 trillion.

As of 2020, Dangote Cement in its Nigerian operations reported an 18.0% year-on-year increase in revenue driven mainly by volume growth (+12.9% y/y) and minimal price growth (ex-factory price; +4.5% y/y).

Similarly, in its financial performance for the year ended December 31, 2019, Dangote Cement declared a group profit after tax (PAT) of N200 billion while in 2018, the PAT stood at N390 billion.

Similarly, BUA Cement Plc, Nigeria’s second-largest cement company recorded increased Profit After Tax, PAT by 19.4 per cent to N72. 3 billion for the financial year ended December 31, 2020 as against N60.6bn in the corresponding period of 2019.

The company’s profits also recorded N39.17 billion in 2018

Within the period under review, Lafarge Africa also declared a 98.8% year-on-year growth in profit to N30.8 billion for the financial year of 2020, when compared to the N15.5 billion reported in 2019. It however made a loss of N1.5bn in 2018.

Manufacturers blame low producting retailers for price surge

Chairman of the BUA Group, Alhaji Abdulsamad Rabiu, had, in an interaction with journalists earlier in the year blamed “Simple economics of supply and demand,” for the rising price of cement in the country.

He said Nigeria was not producing enough cement commensurate with its population and the product’s demand.

“Look at the numbers: Nigeria is over 200 million people today in terms of population. If you look at the production of cement, last year, we were under 30 million metric tonnes.

“Nigeria’s 200 million people make it about 130 kilograms per head. If you check, you will see that most countries in Africa are doing between 170 kilogrammes to 200 kilogrammes per head.

“So, Nigeria is actually producing less than other countries in Africa, apart from maybe Niger Republic. So, that means that we do not have enough capacity.”

On its part, the management of Dangote Cement Plc recently said though the company had direct control over its ex-factory prices, it, however, could not influence the pricing of the product when it gets to the market.

Dangote’s Group Executive Director, Strategy, Portfolio Development & Capital Projects, Devakumar Edwin said the company had suspended exporting its product to ensure it meet local demand.

“We also had to reactivate our 4.5 million tonne capacity Gboko Plant, which was shut four years ago, and run it at a higher cost all in a bid to meet demand and keep the price of cement within control in the country.”

By Sunday M Ogwu, Hussaini Yahaya (Abuja), Ibrahim Kegbegbe (Lagos), Clement Oloyede (Kano) & Musbau Bashir (Borno)

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.