The Nigerian Upstream Petroleum Regulatory Commission (NUPRC), on Monday, clarified the recent acquisition of 100 per cent of the shareholding interest in the Nigerian Agip Oil Company (NAOC) by Oando PLC, saying the deal followed regulatory guidelines and in line with the provision of the Petroleum Industry Act (PIA).

The regulatory authorities in the upstream sector also said the process of the divestment by Mobil Producing Nigeria Unlimited (MPNU) to Seplat Energy Offshore Limited (Seplat) is also receiving regulatory approval and would be completed in the next 120 days.

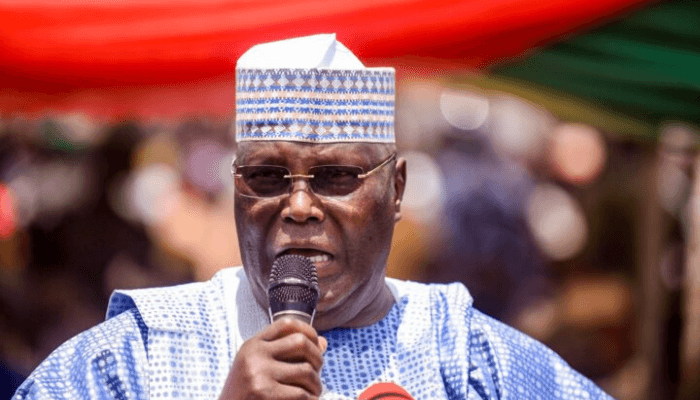

The clarification by NUPRC was in response to recent concerns raised by former Vice President Atiku Abubakar who has taken the government to task on some decisions and actions in the oil industry.

Atiku initially questioned the acquisition of NAOC, the deal, which was worth $783m, asking why it got accelerated approval.

- Farmer: I earn N7m annually from growing tomato, pepper

- Slain officers: ‘You’ve murdered peace’, IGP orders IMN sponsors’ manhunt

But in a statement yesterday through its Head, Public Affairs Unit, NUPRC, Mrs. Olaide Shonola stated that “The approvals given to the NAOC-Oando and Equinor – Chappal divestments were in accordance with the Petroleum Industry Act (PIA) 2021, defined regulatory framework, and standard consent approval process set by the Commission under the PIA.”

She explained that ministerial approval was recently granted to the divestment by NAOC to Oando Petroleum and Natural Gas Company Limited (Oando PNGCL) and OANDO Oil II Cooperatief U.A. (OANDO Cooperatief) (together the “Oando Entities”) and by Equinor Nigeria to Chappal Energies.

According to the commission, the divestment by MPNU to Seplat Energy Offshore Limited (Seplat) is also currently undergoing the same consent approval process and is expected to be completed within the 120-day timeline provided by the PIA.

The statement added that the consent to Oando and Chappal Energies were fulfilled according to the regulatory process.

On the NAOC Divestment, it explained that NAOC by a letter of May 16, 2023, notified the commission of its intention to proceed with the divestment of participating interests in some of its oil and gas assets.

It stated that the commission by a letter dated May 21, 2023, requested NAOC to provide information on the proposed assignee while NAOC in another letter dated July 24, 2023, notified the commission that it had completed the technical evaluation of the companies shortlisted for the proposed transaction and submitted OANDO PNGCL and OANDO Coöperatief as qualified companies for the consideration of the Commission.

It added, “The Commission by a letter dated August 9, 2023, granted approval to NAOC to proceed to the commercial stage of the transaction. Consequently, NAOC, vide a letter of November 7, 2023, made a formal application requesting the consent of the Minister of Petroleum Resources to the NAOC Divestment.

“In line with its processes, the commission by a letter dated December 14, 2023, requested the information contained in the commission’s due diligence checklist on the transaction and NAOC by a letter dated January 10, 2024, provided the information requested via the commission’s letter dated December 14, 2023.

“Consequently, the process was conducted in compliance with the requirements of relevant legislations, regulations and guidelines including the Petroleum Act, Petroleum Industry Act, Petroleum Drilling and Production Regulations, and the Upstream Asset Divestment and Exit Guidance Framework.”

The commission reiterated that the divestment Framework evaluated the divestments based on Technical Capacity, Financial Viability, Legal Compliance, Decommissioning and Abandonment, Host Community Trust and Environmental Remediation, Industrial Relations and Labour Issues, as well as Data Repatriation.

“Additionally, NAOC obtained a waiver of pre-emption and consent to the divestment from NNPC, their partner on the blocks.

“To ensure due diligence, the commission, working with reputable external consultants identified significant pre-sale liabilities inherent in the assets to be divested by NAOC and proactively devised measures to ensure that the identified liabilities are adequately provided for.

“Furthermore, the commission’s thorough evaluation and due diligence process, anchored on the Seven Pillars of the Divestment Framework, ensured that potential assignees were capable and compliant with legal requirements and that all legacy liabilities were identified and appropriately managed.”

The commission further explained that NNPC’s right to pre-emption and consent under the NNPCL/MPNU Joint Venture Joint Operating Agreement was the subject of Suit No: FCT/HC/BW/173/2022 Nigerian National Petroleum Company Limited versus Mobil Producing Nigeria Unlimited, Mobil Development Nigeria Inc., Mobil Exploration Nigeria Inc. and Nigerian Upstream Petroleum Regulatory Commission.

It added, “In June 2024, NNPC and MPNU resolved their dispute with NNPC, and MPNU, by letter dated 26 June 2024 informed the commission of the resolution of the dispute. Upon resolution of this dispute, the commission communicated its no-objection decision to the assignment via a letter dated July 4, 2024 and requested MPNU to provide information and documentation required under the Commission’s due diligence checklist to enable the commission conduct its due diligence as required under the PIA. MPNU by letter dated 18 July 2024 provided the information requested by the commission.

“Accordingly, MPNU’s application to the commission for consent is currently undergoing due diligence review, under the same Divestment Framework applied to the NAOC-Oando and Equinor-Chappal divestment. The commission’s due diligence process is ongoing and within the 120-day timeline required by the PIA.

“Given the above, the commission wishes to assure the public that the process for approving divestment applications is guided by the provisions of the PIA and clearly defined frameworks in the assignment regulations, guided by international best practices.”

NUPRC, stated that as an organisation guided by law and professionalism, “Will continue to pursue its statutory mandate in a legal, independent, technical, commercial, and professional manner, operating under the authority of the PIA.”

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.