‘Pension administrators can’t invest in states with weak revenue profile’

It’s wrong to give our money to governors – Workers

The inability of 27 states to fully or substantially implement the Contributory Pension Scheme (CPS) is the reason Pension Fund Administrators (PFAs) will not invest pension funds in such states.

Data sourced from the National Pension Commission (PenCom) show that despite clamours by state governors to access pension funds for infrastructural development, most of them are either not implementing the new pension scheme or are slow about it.

- Lagos-Ibadan train too expensive for poor Nigerians

- How modern mathematics emerged from a lost Islamic library

While relevant pension laws would not allow them to borrow, the inability of the affected states to implement CPS is also putting millions of pensioners under the new scheme at risk.

As of August 31, 2020, the pension assets under the management of PFAs were worth N11.35 trillion.

Governors have declared interest to borrow from the fund, but the Pension Reform Act, 2014 (PRA, 2014) prohibits such borrowing.

Section 89, subsection 1, paragraph C of the PRA, 2014, provides that a PFA shall not “apply any pension fund assets under its management by way of loans and credits or as collateral for any loan taken by a holder of retirement savings account or any person whatsoever.”

Similarly, section 2, subsection 6 of the 2019 Regulation on Investment of Pension Fund Assets issued by PenCom provides that “A PFA shall not engage in borrowing or lending of pension fund assets.”

Faced with these legal hurdles, the Director-General of the National Pension Commission (PenCom), Aisha Dahir-Umar, said recently that states can access pension funds if they have “safe and viable investment outlets” which PFAs can invest pension funds.

She said PenCom forbids PFAs from investing in states, which have not fully or substantially implemented the new pension scheme.

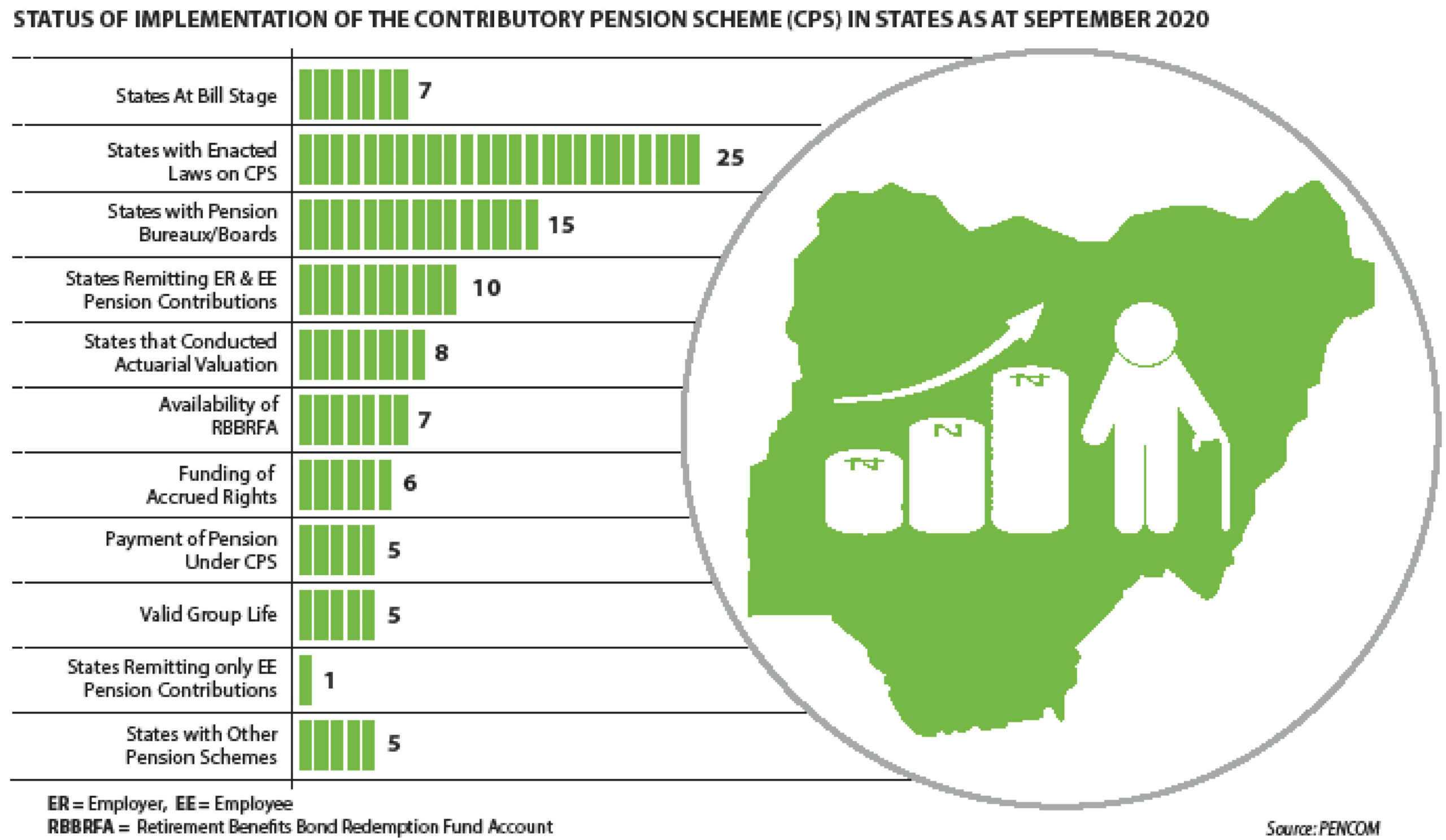

Data from PenCom show that 27 states are still implementing the old Defined Benefits Scheme by not remitting pension under the new scheme.

The hurdles for the states

To be adjudged as implementing the new contributory scheme, a state must draft a CPS Bill modelled after the PRA being implemented by the federal government and the private sector, pass the bill into law, set up a contributory pension board or Bureau, appoint a PFA, conduct an actuarial valuation to determine accrued pension rights, open a Retirement Benefits Bond Redemption Fund Account (RBBRFA) with the Central Bank of Nigeria (CBN), start remitting employer and employee monthly pension and also put in place a Group Life Insurance Policy for employees.

Details of the level of implementation of the CPS at the state level obtained from PenCom show that as at the end of September 2020, only nine states and the Federal Capital Territory (FCT) have substantially implemented the new pension scheme by remitting employer and employee pension contributions.

These states are Lagos, FCT, Osun, Kaduna, Delta, Ekiti, Ondo, Edo, Benue and Anambra.

Records show that Kebbi State is remitting only employee pension contribution in violation of the CPS law which requires the state government to also remit its employer contribution.

While 25 states have enacted laws on CPS, seven are still at the bill level more than a decade and a half since the scheme came into existence at the federal level.

States yet to enact laws on CPS include Kwara, Plateau, Cross River, Borno, Akwa Ibom, Bauchi and Katsina.

Jigawa, Kano, Yobe, Gombe and Zamfara states operate other pension schemes different from the contributory pension scheme.

Out of 25 states that have enacted laws on CPS, only 15 have pension boards or bureaux and they include Lagos, FCT, Osun, Kaduna, Delta, Ekiti, Ondo, Edo, Benue, Kebbi, Niger, Rivers, Ogun, Bayelsa and Kogi.

PenCom’s records show that only eight states have conducted actuarial valuation, which is a critical component in the implementation of the scheme for ease of transition from the old to the new scheme in such a way that pension entitlements of workers before the scheme are determined and factored into the new scheme.

These include Lagos, FCT, Osun, Kaduna, Delta, Ekiti, Rivers and Anambra.

However, out of the eight states that have conducted actuarial valuation, only six are funding the accrued pension rights of workers determined during the valuation. The states include Lagos, FCT, Osun, Kaduna, Delta and Anambra.

It is worth noting that only Lagos, FCT, Osun, Ondo and Edo states have valid Group Life Insurance for their workers. This means that at an event of the death of any employees in other states, their families may have no insurance cover to fall back on.

Despite the low implementation of the CPS at the state level, and by implication not qualified to access pension funds through bonds, treasury bills and other investible financial instruments, governors declared they wanted to borrow pension funds even when the PRA, 2014 is clearly against it.

The Socio-Economic Rights and Accountability Project (SERAP) recently disclosed that it had asked President Muhammadu Buhari to instruct the Director-General and Board of the PenCom to stop the 36 state governors from borrowing and/or withdrawing from the pension funds for infrastructural development.

In a statement on its official Twitter handle, the advocacy organisation said, “The governors last week reportedly proposed to borrow around N17trn from the pension funds after receiving a briefing from Kaduna State Governor, Malam Nasir El-Rufai, Chairman of the National Economic Council Ad Hoc Committee on Leveraging Portion of Accumulated Pension Funds.”

Urging the president to stop the proposed borrowing, SERAP said it would lead to serious losses of retirement savings of millions of Nigerians.

Similarly, the Nigeria Union of Pensioners (NUP) has kicked against the plan to borrow from the pension fund, noting that the government has no authority over the money and should, therefore, not tamper with it.

NUP’s Head of Information, Bunmi Ogunkolade, said the governors have no authority over the money as it does not belong to them.

“How can they approve a proposal to borrow part of the workers’ pensions, which many of them (governors) are not contributing to? Do you know that many of the states are not paying the contributory pension?” he queried.

Pension funds not near N17trn

Meanwhile, checks show that governors cannot borrow the said N17trn for several reasons.

To start with, the entire pension fund and assets under the Contributory Pension Scheme (CPS) is not up to N17trn.

In any case, even if the nation’s total pension assets are more than N17trn, the Pension Reform Act (PRA) 2014 would not allow the governors to withdraw or borrow the said fund.

This simply means that governments at federal, states and local levels can only access pension fund assets through investments made by the PFAs in Treasury Bills issued by the Central Bank of Nigeria or Bonds (including Sukuk) approved by the Securities & Exchange Commission (SEC) and other relevant Institutions.

The PRA 2014 and the 2019 Regulation on Investment of Pension Funds stipulate the allowable financial instruments in which pension fund assets can be invested and these are Equities; Federal Government Securities; State/Local Government Bonds; Corporate Debt Securities; Money Market Instruments; Open/Closed-end Funds; Infrastructure Bonds & Funds; Private Equity Funds and any securities/instruments that may be approved by PenCom, from time to time.

In any case, even if the governors hide under state securities to access pension funds for infrastructure development, they will still not be able to make PFAs invest in them because most of the states do not comply with the CPS.

The low compliance with the CPS at the states may not be unconnected to the low investments by PFAs in state securities.

For instance, PenCom reported that as of August 31, 2020, only N148.13bn pension fund has been invested in state securities, translating to merely 1.31 per cent of the total pension assets of N11.35trn.

It is important to note that such investments are not loans as the PFAs can divest from such investments at any time, have limitations on the percentage of pension funds to be invested in each security, and only invest in them from expert analysis based on projected returns on investment and safety of the funds.

PenCom boss, Dahir-Umar, said “there are limited Infrastructure Bonds and Funds available for pension funds to invest. It is expected that PFAs would continue to make pension funds available for infrastructure financing as long as the products offered are viable, bankable and meet the requirements of the Regulation.”

Similarly, the Minister of Finance, Budget and National Planning, Mrs Zainab Shamshuna Ahmed, recently dispelled rumours of government borrowing from pension funds.

Fielding questions when she met with capital market stakeholders this year in Lagos during a visit to the Nigerian Stock Exchange (NSE), Mrs Ahmed said, “We won’t borrow from pension fund assets. Pension funds are very sensitive, so we have to be careful.”

Meanwhile, the chairman of Kebbi State chapter of the Nigerian Labour Congress (NLC), Umar Halidu Alhasssan, and his counterpart of Trade Union Congress (TUC), Danladi Aliyu Dabai, said Kebbi State Government has not been remitting the pension contribution of primary school teachers for the past 72 months.

The duo said the organised labour in the state would embark on strike should the state government refuse to resume remittance and upset the backlog of the pension contribution as one among other reasons for the strike.

When contacted, the Kebbi State Commissioner of Basic Education, Muhammad Magawata Aliero, did not pick the call placed to him and also did not respond to the text message sent to him.

On why Nasarawa State is not remitting pension contributions as required by the Contributory Pension Act, and how soon the state intends to start remitting, the Public Relations Officer of the Nasarawa State Pension Bureau, Ibrahim Dawayya, said: “The Director-General of the Board, Alhaji Abdullahi Osaze, is supposed to respond on pension policy in this state, but he is busy.”

Meanwhile, a senior officer with the Borno State Pension Office in Maiduguri who preferred anonymity said successive governments did not make efforts to join the Contributory Pension Scheme, “for reasons best known to them.”

He said state and local government employees are yet to open accounts with Pension Fund Administrators (PFAs).

The officer said the inability to join the scheme had left the state lagging behind its peers in pension matters.

He, however, said Governor Babagana Zulum had early this year set up a committee to work out a plan on joining the scheme immediately.

“The permanent secretary was supposed to go to Jigawa State with her team and understudy the scheme to properly implement it here. The exercise was not as successful as a result of COVID-19 restrictions. I believe, very soon, the team will be in Jigawa, and when they return, the scheme will become operational,” the officer said.

Some workers said they hope the federal government will put an instrument that will compel states to comply with the new pension scheme.

“Honestly most of the governors are putting our lives in jeopardy by not complying with the new pension scheme,” Said Shehu Salihu, a civil servant in one of the states in North-West.

“I think the idea of the new scheme is to protect workers, to assure them that after they retire, there is something for them.

“But it seems most of the governors are only thinking about themselves and their families. They find pleasure when they see retirees wandering the streets begging and unable to feed.

“These are some of the things that make civil servants corrupt because when you know that at the end of the day you will not be able to access your pension, or the savings have been pilfered, you will be left with no option than to steal when you have the opportunity while in office,” he said.

Rahila Sam, a school teacher in one of the states in North Central, said she does not support the idea of giving pension funds to governors.

“The governors should trim down their security votes and cut down their severance package. They should also prioritize their projects. They should look for other ways and borrow because pension funds are not for them.

“I think they have exhausted all avenues of borrowing and there is nothing to show for that. So, I don’t think if they would do something serious even if they get the pension fund,” she said.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.