Twenty one states of the federation are seeking loans amounting to N1.65 trillion to fund their 2024 budget deficits despite the increase in the allocations they have received from the Federation Account Allocation Committee (FAAC) in the last one year.

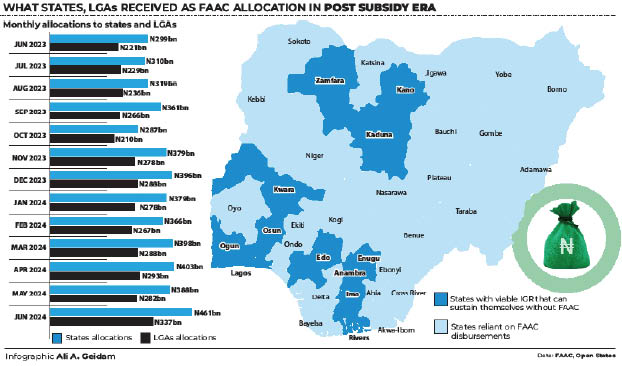

From June 2023 to June this year, all the 36 states and the 774 local governments received a total of N7.6 trillion from FAAC. This increase in revenue is largely due to the removal of petrol subsidy by the federal government on May 29, 2023.

Findings by Daily Trust show that the 36 states are projected to receive N5.54 trillion from FACC for this year as against the N3.3 trillion disbursed to them last year.

Under the current revenue-sharing formula, the federal government receives 52.68 percent; while states and local governments get 26.72 percent and 20.60 percent respectively. Such federation revenues, in addition to internally generated revenues of each tier, are expected to facilitate development across the three tiers of government, and also ensuring that the governments fulfill their financial obligations.

- Farmer: I earn N7m annually from growing tomato, pepper

- Slain officers: ‘You’ve murdered peace’, IGP orders IMN sponsors’ manhunt

The FAAC allocations to local governments for June were paid directly to the state governments.

The Supreme Court had, on July 11, affirmed financial autonomy for the local governments. The apex court directed that the financial allocations meant for all the 774 local government areas in the country be paid to them directly. It said it is unconstitutional for state governments to keep and manage allocations on behalf of the local governments.

States’ borrowing patterns

Investigations by Daily Trust show that 21 states have expressed intentions to borrow a total sum of N1.650 trillion from both internal and external sources to fund their 2024 budget deficits.

Other states are yet to upload their borrowing plans.

According to details of the borrowing plans made public, the Adamawa State Government is to borrow N68.46 billion; Anambra N245 billion; Bauchi, N59.08 billion; Bayelsa, N64 billion; Benue, N34.69 billion; Borno, N41.71 billion; Ebonyi, N20.5 billion; Edo, N42.71 billion and Ekiti State, N27.15 billion.

Others are Jigawa, N1.78 billion; Kaduna, N150.1 billion, Kebbi, N36.7 billion; Katsina, N163.87 billion; Kogi, N37.08 billion; Kwara, N30.76 billion; Osun, N12.36 billion; Oyo, N133.4 billion; Nasarawa, N32.93 billion; Gombe, N73.75 billion; Enugu, N103 billion and Imo, N271.34 billion.

Breakdown of states’, LGAs allocations in 1yr

The monthly FAAC allocations to the 36 states and the 774 local governments from June last year to June this year stood at N7.6 trillion. This represents an increase of over 40 per cent.

In June 2023, states got N299.92 billion; local government councils (LGCs), N221.79. July: states, N310.670 billion, LGCs, N229. 409 billion. August: states, N319.52 billion; LGCs, N236.23 billion. September: states, N361.19 billion; LGCs, N266.54 billion. October: states, N287.07 billion; LGCs, N210.90 billion. November: states, N379.41 billion; LGCs, N278.04 billion. December: states, N396.693 billion and LGCs, N288.928 billion.

In January this year, state governments got N379.407 billion; LGCs, N278.041 billion. February: states, N366.95 billion; LGCs, N267.15 billion. March: states, N398.689 billion; LGCs, N288.688 billion. April: states, N403 billion; LGCs, N293 billion. May: states, N388.419 billion; LGCs, N282.476 billion. June: states, N461.979; LGCs, N337.019 billion.

Allocations from Value Added Tax also rose year-on-year by 228.8 percent to N2.42 trillion in the first five months of 2024, up from N736.06 billion in the first five months of 2023.

The 13 percent derivation fund received by oil producing states also rose by 234 percent to N519.83 billion in the first five months of 2024, up from N155.5 billion in the first five months of 2023.

20% of June allocation enough to build 320 PHCs

In June this year alone, the FAAC allocations to both states and local governments crossed the N1 trillion mark with N1.3 trillion.

If the standard of N500 million outlined by the World Health Oganisation (WHO) for establishment of an averagely equipped primary healthcare centre facility is anything to go by, 20 percent (N160 billion) of the June allocation is enough to put in place 320 of such health facilities nationwide.

There’s need for accountability – Experts

The Executive Director of the Centre for Fiscal Transparency and Public Integrity, Umar Yakubu, said there is a need for accountability regarding how the allocations to the states are being spent. In an interview with Daily Trust, Yakubu noted that the removal of the petrol subsidy has led to a significant increase in revenues, especially at the states and local governments.

He said: “The major issues is that governments think the more they make revenue, the more they solve problems because the accountability mechanism is so weak and the audit processes are not good enough to check excesses.

“So, what you have is more Naira into the system and the few who have access to them will convert them to dollars, which is the major reason our foreign exchange market has not stabilised because of too much Naira chasing few dollars.

“Therefore, we call for accountability which has to be in place to check corruption because as you can see, more money has come, but no state is recruiting, no state is increasing pensions or allowances of workers or event increasing capital expenditures because they are just siphoning money without accountability”, he said.

Also speaking to Daily Trust, a development expert, Victor Agi, said if the issue of accountability at the sub-national level is not tackled head-on, the challenges at the grassroots would continue.

Agi said state governments must be accountable with the increased revenues to drive growth at the grassroots.

“One of the issues is that people always blame bad governance on the federal government, forgetting that governors also get huge allocations to develop their various states.

“In the last one year, revenues have grown by almost 50 per cent, yet the governors can’t improve welfare of their workers and the people in general. For instance, the president signed the national minimum wage of N70,000 and some of the governors are kicking that they can’t pay despite increase in revenues. This indicates that something is wrong.

“What is more disturbing is that the same issue will now be encountered in the local governments now that their allocations will be paid directly. There is need for more awareness from civil society to ensure that development at the grassroots is implemented now that revenues have increased,” he said.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.

Join Daily Trust WhatsApp Community For Quick Access To News and Happenings Around You.