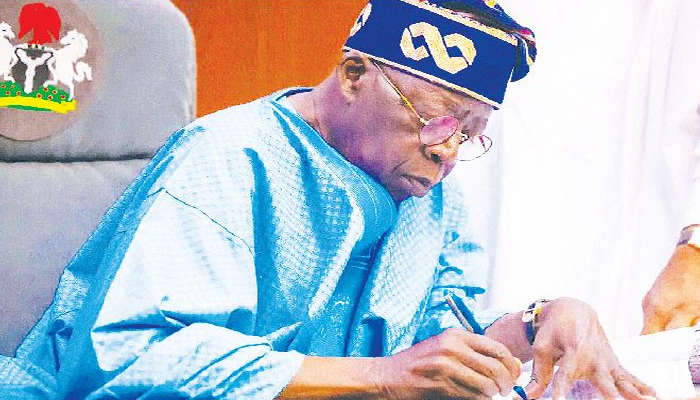

On April 3, President Bola Ahmed Tinubu signed into law the Student Loans (Access to Higher Education) Act (Repeal and Re-Enactment) Bill, 2024, which creates the facility for students to access loans that will aid their pursuit of higher education.

This is an important intervention in reforming education and access to higher learning in a country with one of the world’s highest illiteracy rates. This high illiteracy rate is mostly a product of poverty, with 46 per cent of the populace, representing 108 million people, living below the poverty line and, therefore, unable to afford tuition costs. The other major contributor is socio-cultural orientation.

We commend the government for the humane approach to student loans as captured in the law, unlike what is obtainable elsewhere. For instance, the law allows two years after the completion of the National Youth Service programme, to initiate loan recovery efforts. The law also takes into consideration the realities of securing employment in the country and allows for the extension of the loan recovery effort initiation upon request should the beneficiary not secure employment.

One of the major hitches with the initial bill was the restrictions attached to family income, which would have disqualified a section of Nigerians. Tying the loan to a student’s parents’ loan history and income would have been a major impediment to the scheme. We are relieved to see that the government addressed this concern by taking out the clause.

- We need advanced tech to address insecurity, Zamfara gov tells UN

- NewsDirect founding publisher honoured with posthumous award

We also applaud the loan forgiveness clause in the event of death or some acts that could lead to inability to pay. These will ensure that grieving families of beneficiaries of the loan are not burdened with repayment of the loan.

However, we must remind the government and the Nigeria Education Loan Fund (NELFUND), which has been tasked with managing the funds, that the scheme, while being an initiative to grant access to higher education for Nigerians who may not otherwise afford it, must not be treated with the habitual callousness that other social empowerment schemes have been administered. These are loans, not charity handouts, and the government and NELFUND must show serious commitment to recovering the money.

This commitment will ensure that applicants for the loans do so with the full intention of repaying so that there are enough funds in the kitty for others to benefit. At the same time, this will ensure that the loans are not taken with levity and misapplied by the beneficiaries for purposes other than intended. This is especially vital, considering that the loans are interest-free, which means there will be a defined fund circulating within the purse. Making the loans interest-free ensures that they are accessible to Nigerians whose religious persuasion forbids them from operationalizing interest. It also avoids the slippery slope that countries like the United States have found themselves on.

In the US, beneficiaries of student loans have been enslaved by paying off interest while the principal loan remains un-serviced. This has seen them trapped in financial bondage for years, sometimes up to a decade, limiting their financial growth and prosperity.

To this end, NELFUND must ensure that it applies stringent mechanisms to minimize delinquency. It could use information from the national identity database, such as the BVN, to verify claims that the beneficiaries are employed or otherwise to determine the recovery of the loans.

In the last few years, the Nigerian government has handed out billions in purported soft loans without any definitive measures to recover those loans, thereby depriving future beneficiaries of the chance to access the funds. NELFUND must, therefore, learn from the failings of the previous loan and social empowerment schemes and guard against them.

At the same time, the scheme must ensure that funds are accessed by the people who are most in need of them. At no point should this be abused to become a source of handouts for relatives or loved ones of public officials.

The need for regulatory oversight to ensure the proper application of the scheme cannot be overemphasized. NELFUND must, therefore, ensure that its activities and the process of awarding the loans are transparent, fair and equitable and that the funds are administered without prejudice and bias.

While we commend the FG for signing the bill into law, we must also caution prospective beneficiaries to treat the loans with respect, ensure that they need them before applying and that they fully intend to repay them so that others down the line could benefit from them.

This is a commendable initiative, and the government, NELFUND and prospective beneficiaries must ensure it is not abused and misapplied. If Nigeria will develop, it must do so on the backs of an educated population, and this scheme might just help make that possible.